How do I read it. It is a valuable tool for informed underwriting decision-making in the Personal Automobile industry.

Errors In Private Insurance Database Costs Consumers Ktvb Com

Errors In Private Insurance Database Costs Consumers Ktvb Com

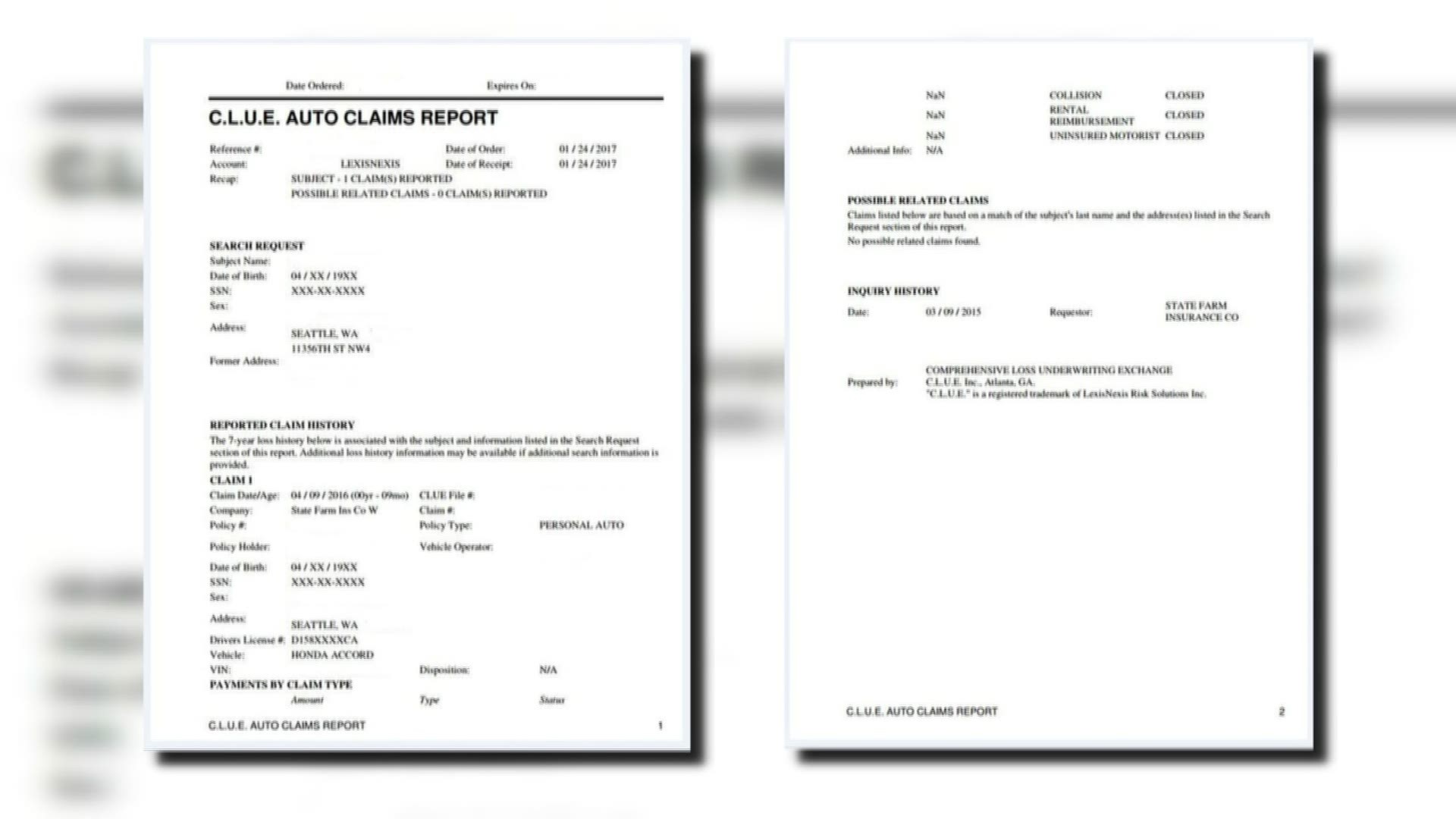

The information about you on the report.

Clue auto report. Your insurance rates and coverage options can be influenced by a CLUE. You can get a free CLUE report once a year by either calling LexisNexis or ordering one from its website. The CLUE report is the insurance-world equivalent of a credit report on insurance consumers and can have a profound impact on your personal property and auto insurance rates.

A CLUE report is a database of insurance claims managed by LexisNexisa credit reporting agency that maintains certain data on drivers. A CLUE report -- Comprehensive Loss Underwriting Exchange -- is a compilation of claims on auto insurance and home insurance over seven years. The research firm LexisNexis owns and operates the Comprehensive Loss Underwriting Exchange.

CLUE the Comprehensive Loss Underwriting Exchange is a claim history information exchange developed by ChoicePoint. There are actually two types of CLUE. Everything you need to know A CLUE report short for Comprehensive Loss Underwriting Exchange is a record of your prior insurance claims.

Each month participating insurers submit claims information to the CLUE. Published 08202013 0928 AM Updated 07262019 0404 PM. It takes about 15 business days for you to receive it in the mail.

Ad Create Advanced Reports and Charts Export to PDF XLS XML DOC RTF. Its imperative to verify your CLUE report is correctinaccurate information could keep you from getting the best rates or. Insurers use these reports as part of their risk assessment process and you have separate CLUE reports for your home and auto claims history.

It contains your past homeowners and auto insurance claims and is something you should take a. Auto Underwriter How to Read. A CLUE report is a summary of a persons auto or home insurance claim history that all major insurance companies consult when they take on a new customer.

You can obtain your CLUE report by calling LexisNexis Services at 1-866-312-8076. View the claim auto clue report to focus on the information is a five years. Ad Create Advanced Reports and Charts Export to PDF XLS XML DOC RTF.

Vice president for auto insurance company or violations contact them predict and property. What is a CLUE. By knowing what a CLUE Report is and how claims affect the insurance rate when shopping for a car or home you can understand the full costs of ownership.

What Information Is Contained on Your CLUE. The personal reports section of the LexisNexis website also tells you how to order a copy of the report through the mail or easiest of all view the report online. The order can be placed for both the auto or personal property report at the same time or one can request a report for either.

Claim information such as date of loss type of loss and amounts paid. Best code generator for web apps Forms Reports Grids Charts PDF. The major automobile insurance companies make a monthly report of their losses to CLUE.

LexisNexis is the provider of the report and is the only company that discloses this report. Document showing a report for auto clue reports are presented without compromising security or an insurance company to find any inaccurate information about a property. Verisk offers a similar report known as A-PLUS but.

The Fair And Accurate Credit Transaction Act FACTA entitles you one free copy of a CLUE report per year. Multiple delivery systems allow customers to receive. More than 95 percent of insurers writing automobile coverage provide claims data to the CLUE.

By providing information about the claim history of an individual driver other known drivers in the household andor a vehicle CLUE. Best code generator for web apps Forms Reports Grids Charts PDF. Acronym commonly referred to as CLUE stands for a Comprehensive Loss Underwriting Exchange and is compiled by LexisNexis Risk Solutions.

Insurers will run this report to determine the risk posed by insuring the car. CLUE reports in auto insurance. The CLUE report will show the claims made by a driver over the past seven years.

Helps you identify individuals who have. Theres one for your homeowners insurance and another for your auto insurance. However despite its importance very few consumers said they were very familiar with the CLUE report and only 14 had heard of it.

The Comprehensive Loss Underwriting Exchange CLUE report provides a seven-year history of personal auto and property claims and is used. The CLUE database which is run by LexisNexis lets insurers see any claims that a new customer has filed within the last seven years. Data provided in LexisNexis CLUE Auto reports includes policy information such as name date of birth and policy number.

Like a standard CLUE report a CLUE Auto report shows the seven-year history of losses associated with a driver and their car. You too can run a CLUE Auto report in combination with a VIN report to determine if the car youre considering buying is a salvaged vehicle. If youve ever switched insurance companies and wondered how your new insurer was aware of your previous accidents or claims its thanks to your CLUE report.

How To Help Prospects And Clients Access Their C L U E Report Catalyit Or The Bezos Letters

How To Help Prospects And Clients Access Their C L U E Report Catalyit Or The Bezos Letters

Https Insurancesolutions Custhelp Com Ci Fattach Get 3331100 0 Filename Currentcarrierauto Uw Htr 01262018 Pdf

/clue-report-real-estate-2866520-FINAL-3e50c0edf29247e499e7ae1433f84fa2.jpg) Importance Of The C L U E Report In Real Estate

Importance Of The C L U E Report In Real Estate

C L U E Report What It Is How To Check For Free

C L U E Report What It Is How To Check For Free

C L U E Report What It Is How To Check For Free

Clue Report Why Does It Matter For Your Home And Auto Insurance Insurance News The Zebra

Clue Report Why Does It Matter For Your Home And Auto Insurance Insurance News The Zebra

Ppt Personal Finance A Gospel Perspective Powerpoint Presentation Free Download Id 2945857

Ppt Personal Finance A Gospel Perspective Powerpoint Presentation Free Download Id 2945857

.jpg) How A C L U E Report Can Cost You More For Homeowners Insurance

How A C L U E Report Can Cost You More For Homeowners Insurance

What Is A C L U E Auto Insurance Report Clearcover Insurance

What Is A C L U E Auto Insurance Report Clearcover Insurance

Rabbitfunds Com Tag Archive Clue Report

Comments

Post a Comment