The earnings test is an individual test. Social Security Medicare Part B premiums are now excluded from income.

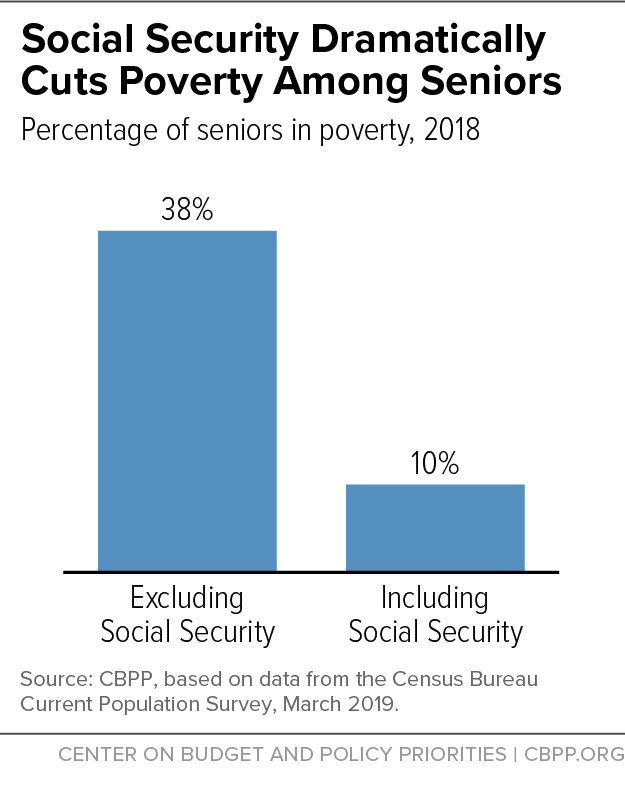

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

You do not need to be on MassHealth to enroll in PACE.

Does social security count as income for pace. If you are referring to the earnings limit for early retirement benefits. Meet the Social Security Act Title XVI disability standards if 55 through 64 years of age. Covered drugs based on 30-day supply.

For a single person total income can be between 14500 and 27500. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Due to retirement age standards it is entirely possible that you are able to receive Social Security payments while still earning a paycheck from a job.

The simplest answer is yes. The effect of these calculations is that a Social Security benefit replaces more of the income of lower-wage earners than it does for higher-wage earners. However if you meet the income and asset guidelines described below you may be eligible for MassHealth and MassHealth may pay your PACE premium.

We need the context. As a participating senior in a PACE program any financial burden you may have is not directly dependent on your income from Social Security benefits or other sources. Additionally the Social Security Administration will often want clarification on the timing of your earnings.

However for 2021 any amount above 142800 would only have contributions to Medicare not to Social Security. But it is dependent in an indirect way because your eligibility for Medicaid depends on your income and resources. PACE FACTS A single persons total income from last year must be 14500 or less.

Since 2014 Social Security Medicare Part B premiums are excluded from income. Your question needs a lot more detail for a correct answer. Social Security Medicare Part B premiums are excluded from being counted toward income levels.

Find out more information about dependent adult Social Security benefits below. Thats the quick and dirty on the earnings limit so lets back to the question were going to work through here. PACENET income limits are slightly higher than those for PACE.

The answer is it depends. For a single person total income must be 14500 or less. Does Your Joint Income Count Against You.

Fifty percent of a taxpayers benefits may be taxable if they are. The IRS and Dependents. This paycheck would count as income in most cases but this will depend on the tax filing income limitations for the filing year when it.

The short answer is yes Social Security income is counted as income for dependents but the full answer is a bit more complicated especially when it comes to taxes. A married couples total combined income from last year must be 17700 or less. If that total is more than 32000 then part of their Social Security may be taxable.

This change has the same effect as raising the income limits by that amount. Does that income still count. The effect is to help level the playing field in retirement between workers of different income levels.

If you a husband and wife who receive Social Security benefits from work they performed their spouses excess earnings. For a married couple combined total income must be 17700 or less. The Social Security Act was signed by President Roosevelt in 1935 and since then everyone who earns an income contributes to Social Security.

Material participation is a highly individualized determination and each case must be decided on its own merits. A landlord of agricultural property can only count earnings from the property as social security income if he or she materially participates in the production or management of agricultural or horticultural commodities. Does joint income count for the earnings test.

As someone asked we think that you are talking about the US Social Security System. The simple but incomplete answer is noit does not count. In some cases you may have earned money while you were still working but didnt receive it until after you stopped working and filed for Social Security.

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on. In 2020 the Social Security taxes were 62. PACE and PACENET eligibility is determined by your previous calendar years income.

Married couples are permitted combined income up to 17700. For most Medicare beneficiaries this amount is 162600 per person for a year. For PACE a single person cannot have countable income of more than 14500.

6 Generic co-pay 9 Brand co-pay PACENET FACTS.

Social Security In Asia And The Pacific Keeps Pace With Rapid Change Socialprotection Org

Social Security In Asia And The Pacific Keeps Pace With Rapid Change Socialprotection Org

How Continuing To Work Can Increase Social Security Benefits

How Continuing To Work Can Increase Social Security Benefits

How Early Retirement Reduces Projected Social Security Benefits

How Early Retirement Reduces Projected Social Security Benefits

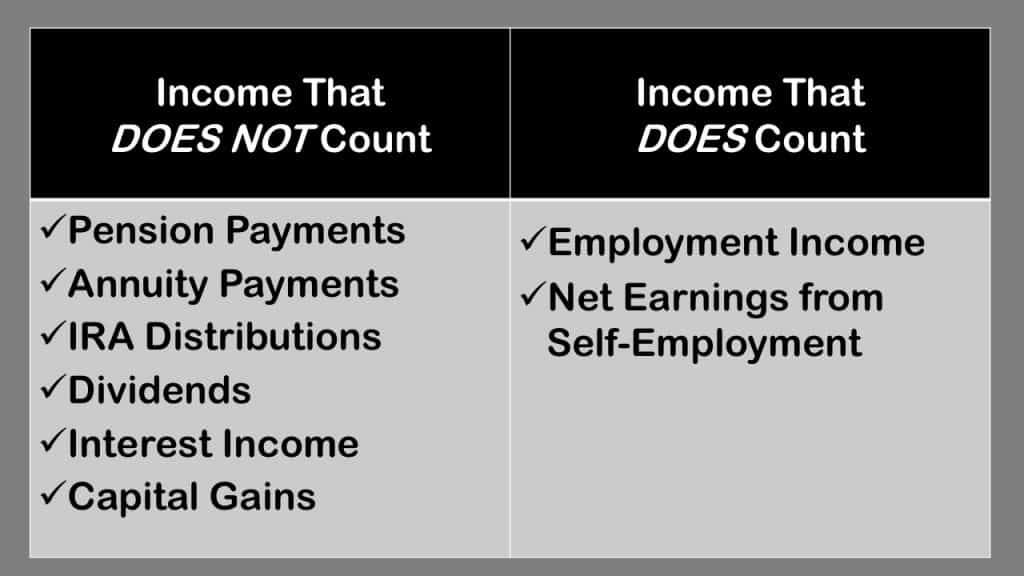

Social Security Income Limit What Counts As Income Social Security Intelligence

Social Security Income Limit What Counts As Income Social Security Intelligence

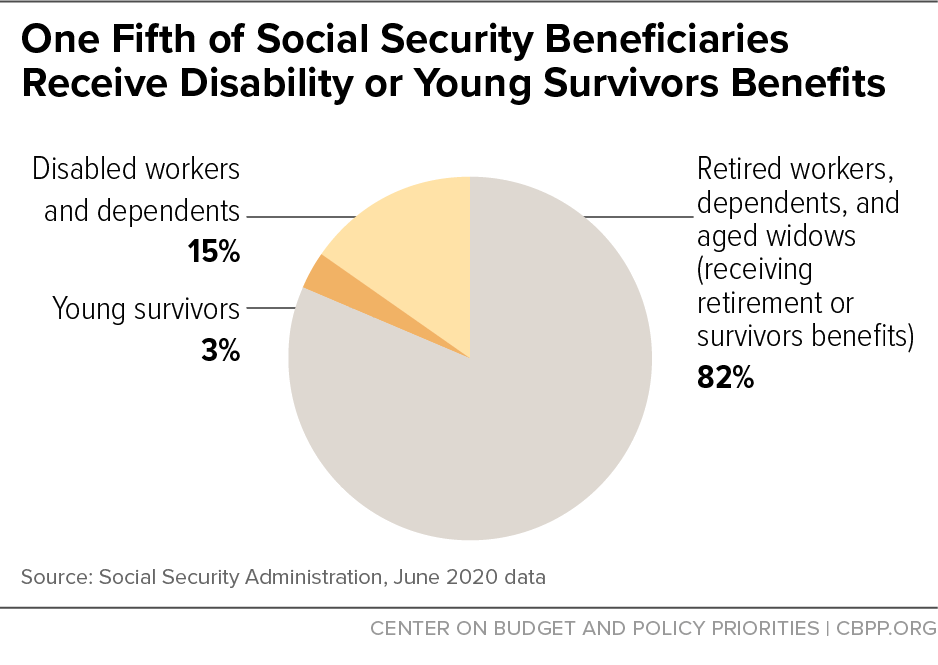

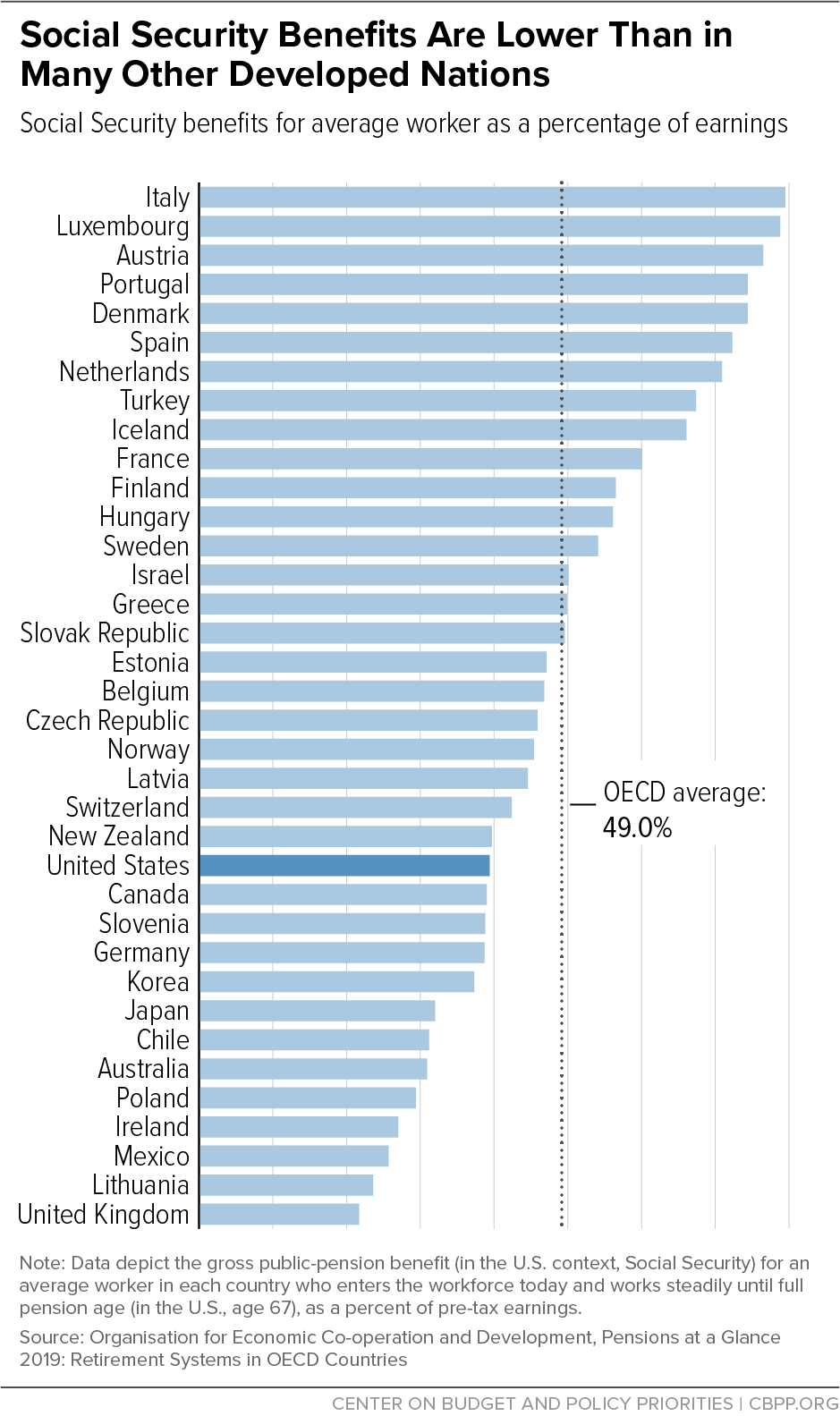

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

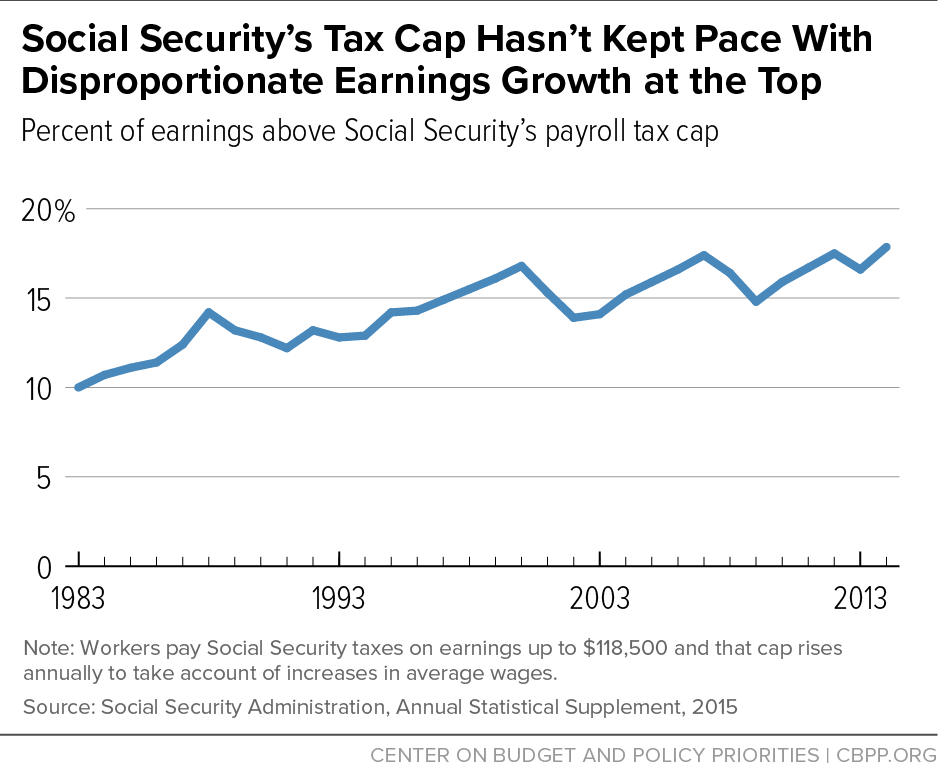

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Social Security Income Limit What Counts As Income Social Security Intelligence

Social Security Income Limit What Counts As Income Social Security Intelligence

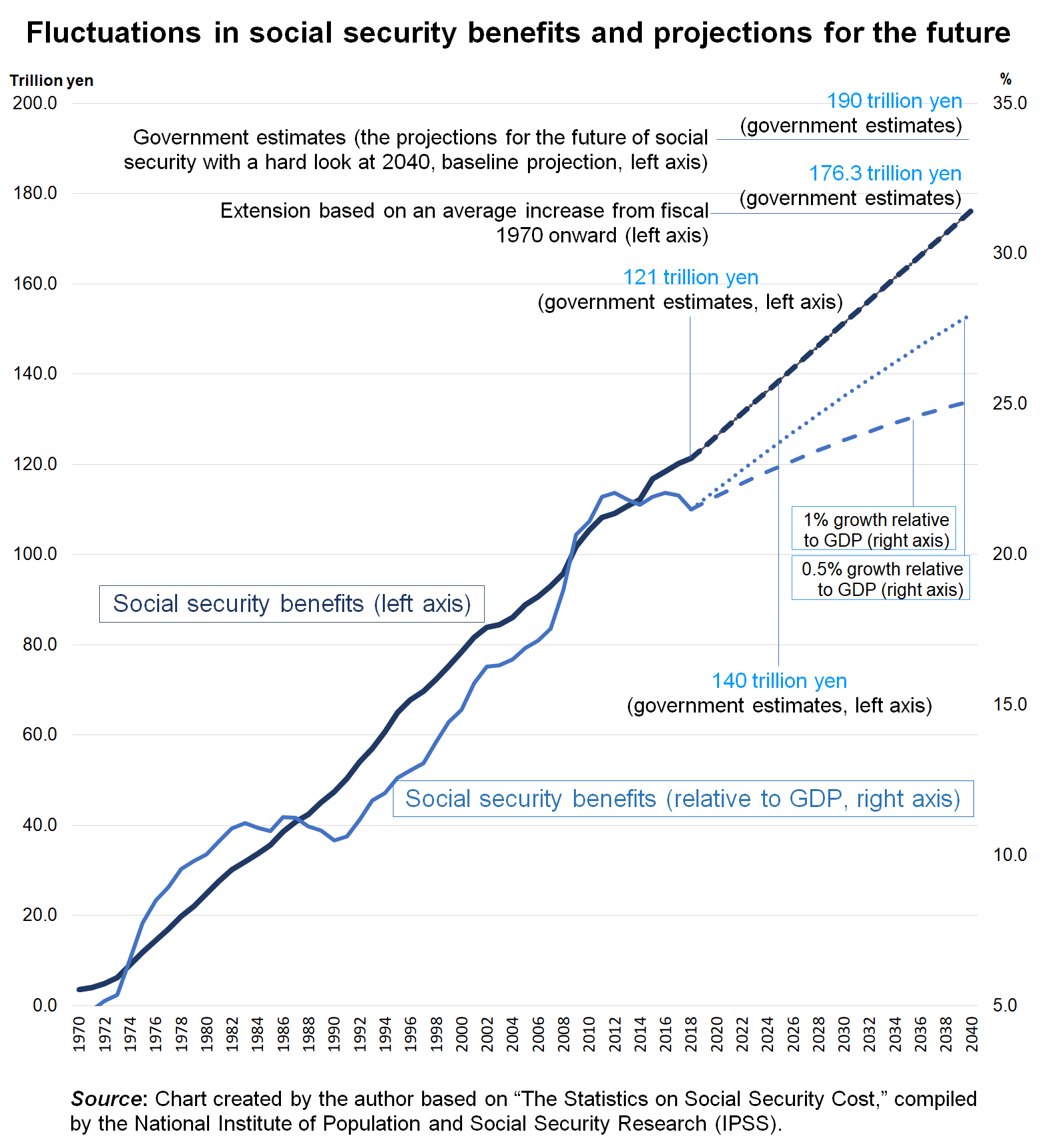

Issues Concerning Social Security For All Generations A System For Contribution According To Individual Income Levels Discuss Japan Japan Foreign Policy Forum

Issues Concerning Social Security For All Generations A System For Contribution According To Individual Income Levels Discuss Japan Japan Foreign Policy Forum

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

10 Myths And Misconceptions About Social Security

10 Myths And Misconceptions About Social Security

How Early Retirement Reduces Projected Social Security Benefits

How Early Retirement Reduces Projected Social Security Benefits

Comments

Post a Comment