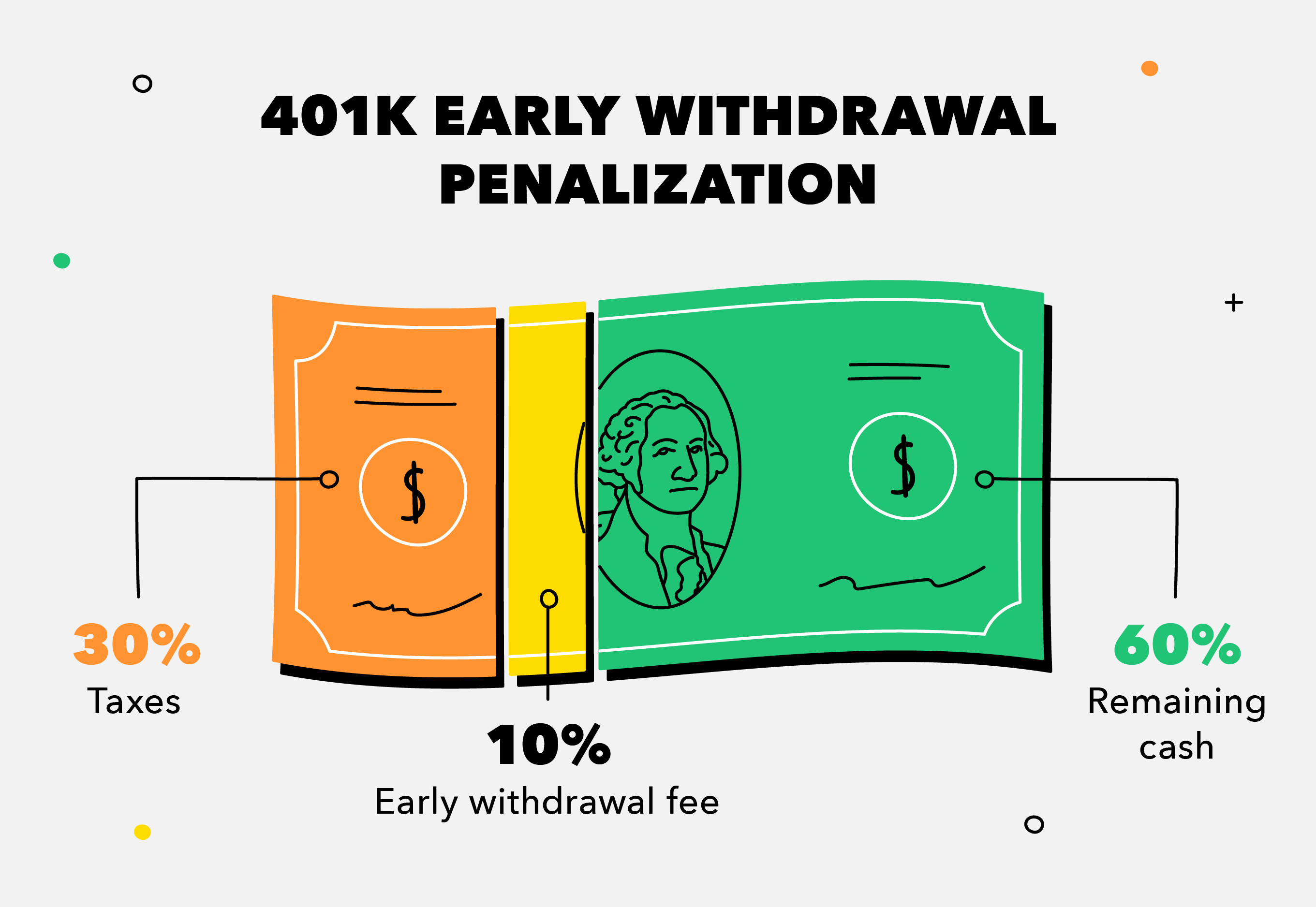

For example if you withdraw 15000 from your 401k plan youll have an additional 15000 in taxable income that year. Of course starting at 70 12 you must start making required minimum withdrawals each year and pay.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

After contributing up to the annual limit in your 401k you may be able to save even more on an after-tax basis.

Do you pay taxes on 401k withdrawals after retirement. While taking any withdrawal from your 401k plan should be the furthest thing from your mind withdrawing after tax assets eases the potential tax burden quite a bit and should be your number one option if. This may come as a surprise because there is some confusion around how retirement accounts work. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

There are no RMDs on Roth IRA accounts to boot. If you fail to take your required minimum distribution you face a tax penalty equal to half of the amount you should have withdrawn from the plan. You pay taxes only on the money you withdraw.

Even after you turn 70 you only pay tax on 401 k withdrawals not what stays in the account. Then consider whether and when to pay back the withdrawal amount. While youve deferred taxes until now these distributions are now taxed as regular income.

How Much Tax Do You Pay on 401k Distributions. That means you will pay the regular income tax rates on your distributions. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401k plans IRAs or pensions. Converting after-tax 401k contributions to a Roth account is an option. Traditional 401ks offer tax-deferred savings but youll still have to pay taxes when you take the money out.

401k Withdrawal Tax Basics. While youve deferred taxes until now these distributions are now taxed as regular income. You pay taxes only on the money you withdraw.

The distributions you receive from an individual retirement account or 401k fund dont affect how much youre entitled to receive in Social Security benefits each month but they can affect the taxes you payThe Internal Revenue Service IRS requires that you pay taxes on some of those benefits if your retirement withdrawals increase your overall combined income past a certain limit. In general Roth 401 k withdrawals are not taxable provided the account was opened at least five years ago. Alabama and Hawaii dont tax pensions but do tax distributions from 401k.

Nine of those states that dont tax retirement plan income simply have no state income taxes at all. If you are wondering whether your 401k withdrawals are taxed the short answer is yes your 401k distributions are likely taxable. With a Roth 401k your contributions come from post-tax dollars.

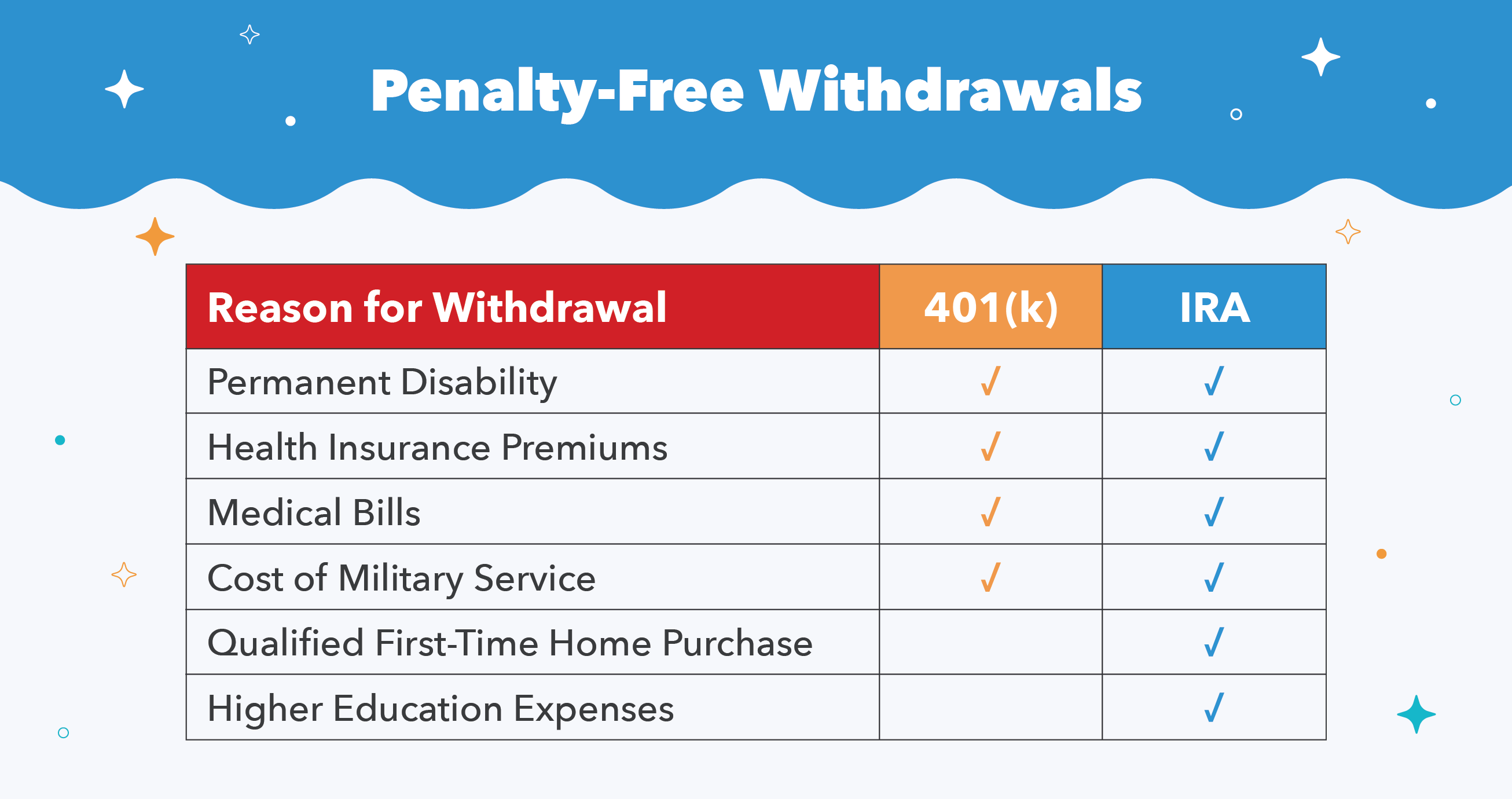

However retirement savers will still owe income tax on withdrawals from traditional 401 ks and IRAs. A 1000 early 401 k withdrawal will result in 240 in taxes for someone in the 24 tax. The trade-off is that Roth contributions are made with after-tax dollars so you need to decide if current savings.

1 Depending on your. A withdrawal you make from a 401k after you retire is officially known as a distribution. When you reach that age you are required to start taking minimum distributions from your retirement plans including your traditional IRA and your 401k plan.

After-tax 401k withdrawals are different than Roth 401k withdrawals. Roth IRA accounts and Roth 401 k accounts allow for tax-free withdrawals in retirement. That means you will pay the regular income tax rates on your distributions.

If you retire after age 59½ the Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without owing a 10 early withdrawal penalty. Earnings on after-tax contributions are considered pre-tax and would grow tax-deferred until withdrawals begin. In the case of a Roth 401k you will have to pay tax on your contributions but you wont be taxed later when you make withdrawals.

A withdrawal you make from a 401k after you retire is officially known as a distribution. Subsequently question is do you pay taxes on 401k withdrawals after retirement. If you pulled money from your 401k plan or individual retirement.

Lastly pay taxes on at least a third of the withdrawal.

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png) Estimating Taxes In Retirement

Estimating Taxes In Retirement

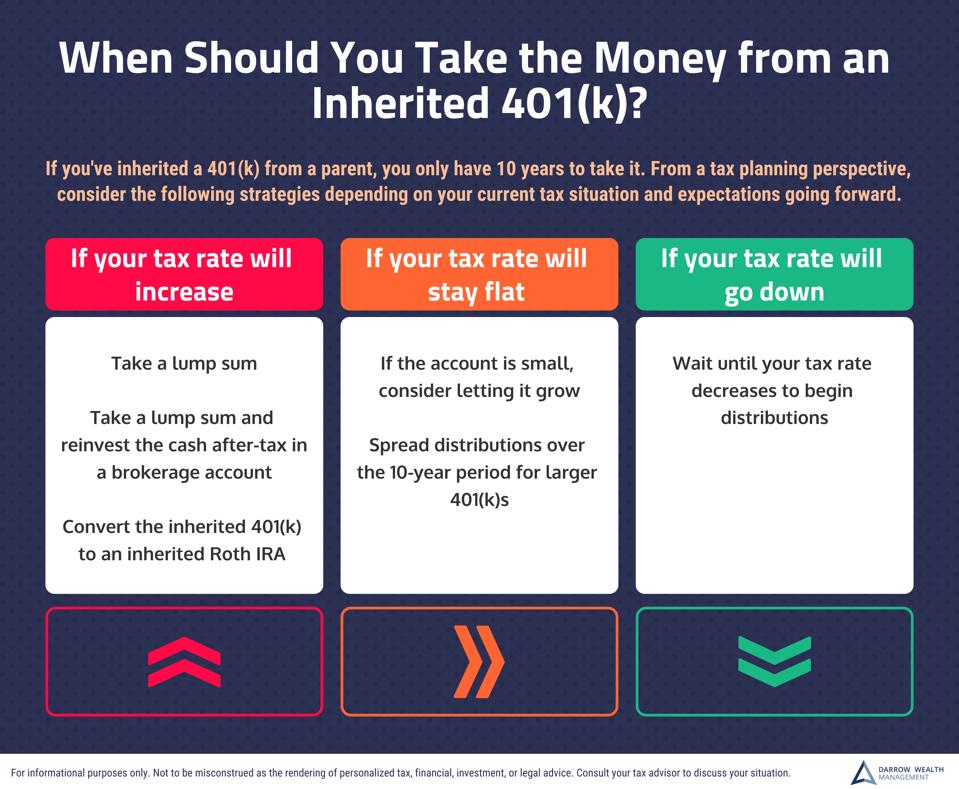

If You Inherited A 401 K From A Parent Here S When You Need To Take The Money And When You Should

If You Inherited A 401 K From A Parent Here S When You Need To Take The Money And When You Should

Cares Act Allows Penalty Free Premature Withdrawals From 401 K Retirement Savings Accounts Should Clients Do It Financial Planning

Cares Act Allows Penalty Free Premature Withdrawals From 401 K Retirement Savings Accounts Should Clients Do It Financial Planning

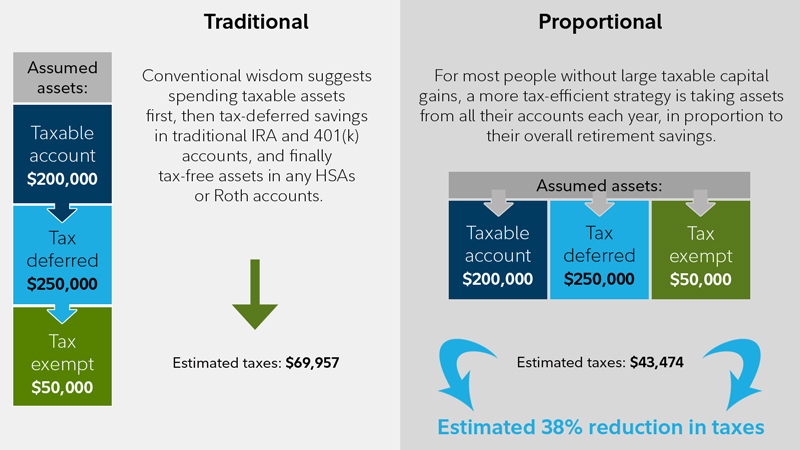

Savvy Tax Withdrawals Fidelity

Savvy Tax Withdrawals Fidelity

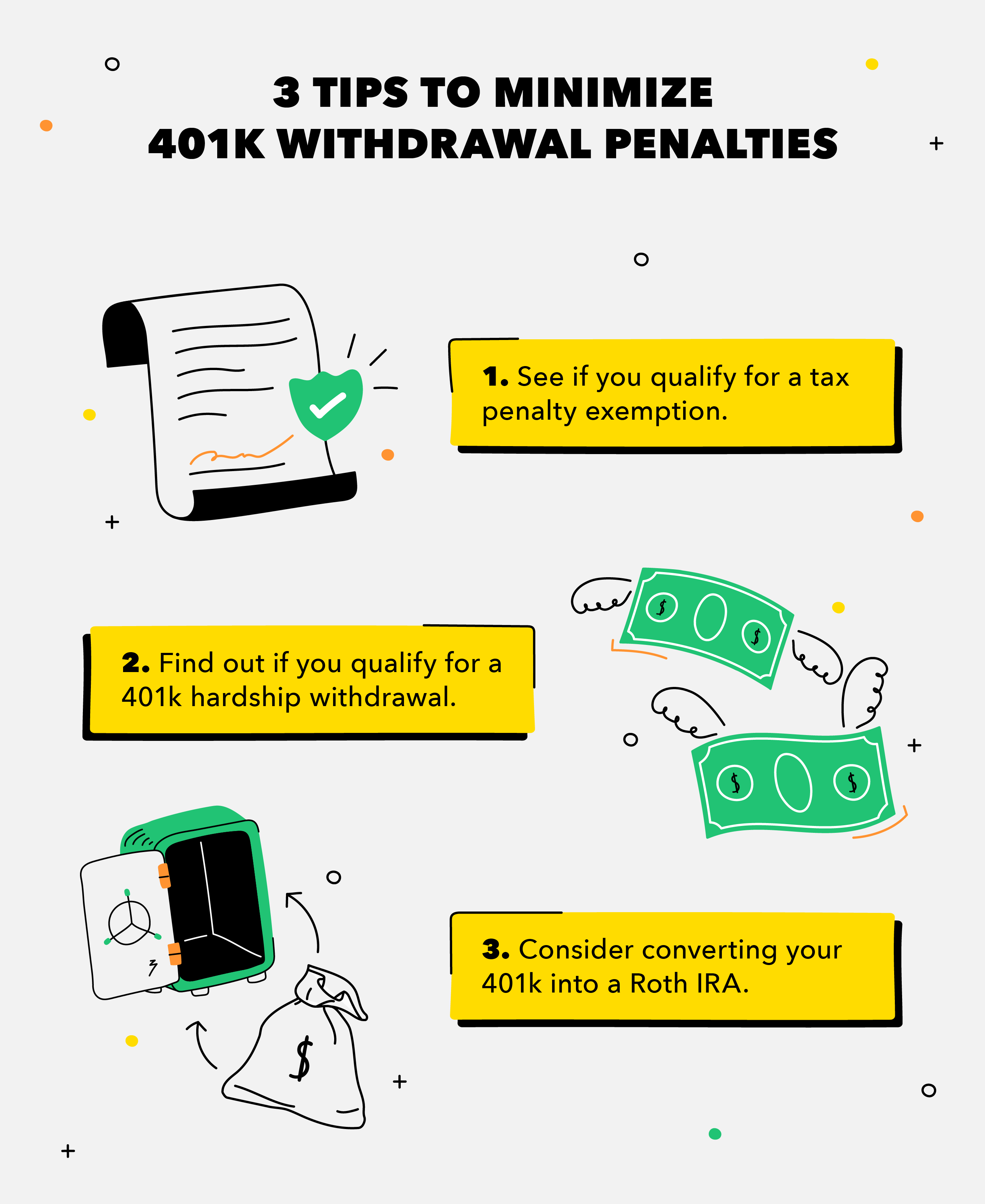

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png) Can I Withdraw Money From My 401 K Before I Retire

Can I Withdraw Money From My 401 K Before I Retire

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

Should I Cash Out My 401k To Pay Off Debt

Should I Cash Out My 401k To Pay Off Debt

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

401k Early Withdrawal What To Know Before You Cash Out Mintlife Blog

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

Do You Pay Taxes On 401 K Withdrawals After Retirement Youtube

Do You Pay Taxes On 401 K Withdrawals After Retirement Youtube

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

Comments

Post a Comment