Wouldnt my annuity be much greater under CSRS. This is somewhat misleading.

Publication 915 2020 Social Security And Equivalent Railroad Retirement Benefits Internal Revenue Service

Publication 915 2020 Social Security And Equivalent Railroad Retirement Benefits Internal Revenue Service

98-21 section 340 to include an additional provision regarding the payment of Social Security benefits to aliens outside the US.

/social-security-survivor-benefits-for-a-spouse-2388918-v3-5bc644f846e0fb0026f5c3e2.png)

Social security 5 year rule. Social Security benefits are based on your highest 35 years of earnings. The five-year rule that applies to conversions only applies for persons under age 59 ½. 10000 one-year rule and.

The 30000 5 year disposal free area applies to all assets disposed of during the current financial year and the previous 4 financial years occurring after 30 June 2002. We apply a formula to. Citizen dependent and survivor beneficiaries who are first eligible for Social Security Benefits after December 1984 must have resided in the US.

The 20 quarters required do not have to be consecutive they can be spread out. Any assessable amount under the 10000 one-year rule resulting from the current assessment of the latest gift. Thirty-five years of earnings are factored into your Social Security benefit.

Your plan should have an in-service withdrawal feature that. The special rule lets us pay a full Social Security check for any whole month we consider you retired regardless of your yearly earnings. In 1983 the Social Security Act was amended PL.

The 30000 5-year rule during the rolling period including. For this year the. We adjust or index your actual earnings to account for changes in average wages since the year the earnings were received.

It starts with Social Security examining your earnings history with an emphasis on the money you earned during your 35 highest-paid years. Deprived assets of recipients qualified or eligible to receive a pension benefit or allowance are assessed for 5 years from the date of the relevant disposal. I have not been able to find any information on that five-year rule.

The initial Social Security eligibility age is 62. We base Social Security benefits on your lifetime earnings. According to one of your responses to a postal employee I just read he was under CSRS even though he was hired a full year after I was.

That means that if you worked 40 years Social Security would use your highest-paid 35 years in its calculations and ignore the other five. SUBTRACT the total from Step 2 from the total from Step 1. If you continue working youll reduce those zero years and drive your benefit up.

The average Social Security payment is 1503 per month in 2020. About the five-year rule. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

I currently make around 50000 a year. Sometimes the requirement is referred to as the five year rule or the five year out of ten year rule. If you have fewer than 35 years of earnings the years in which you dont work will be counted as zeroes in the calculations.

For at least 5 years. Normally people who collect Social Security benefits before their full retirement age currently 66 must forfeit 1 in benefits for every 2 earned over a prescribed limit. Be under full retirement age for all of 2021 you are considered retired in any month that your earnings are 1580 or less and you did not perform substantial services in self-employment.

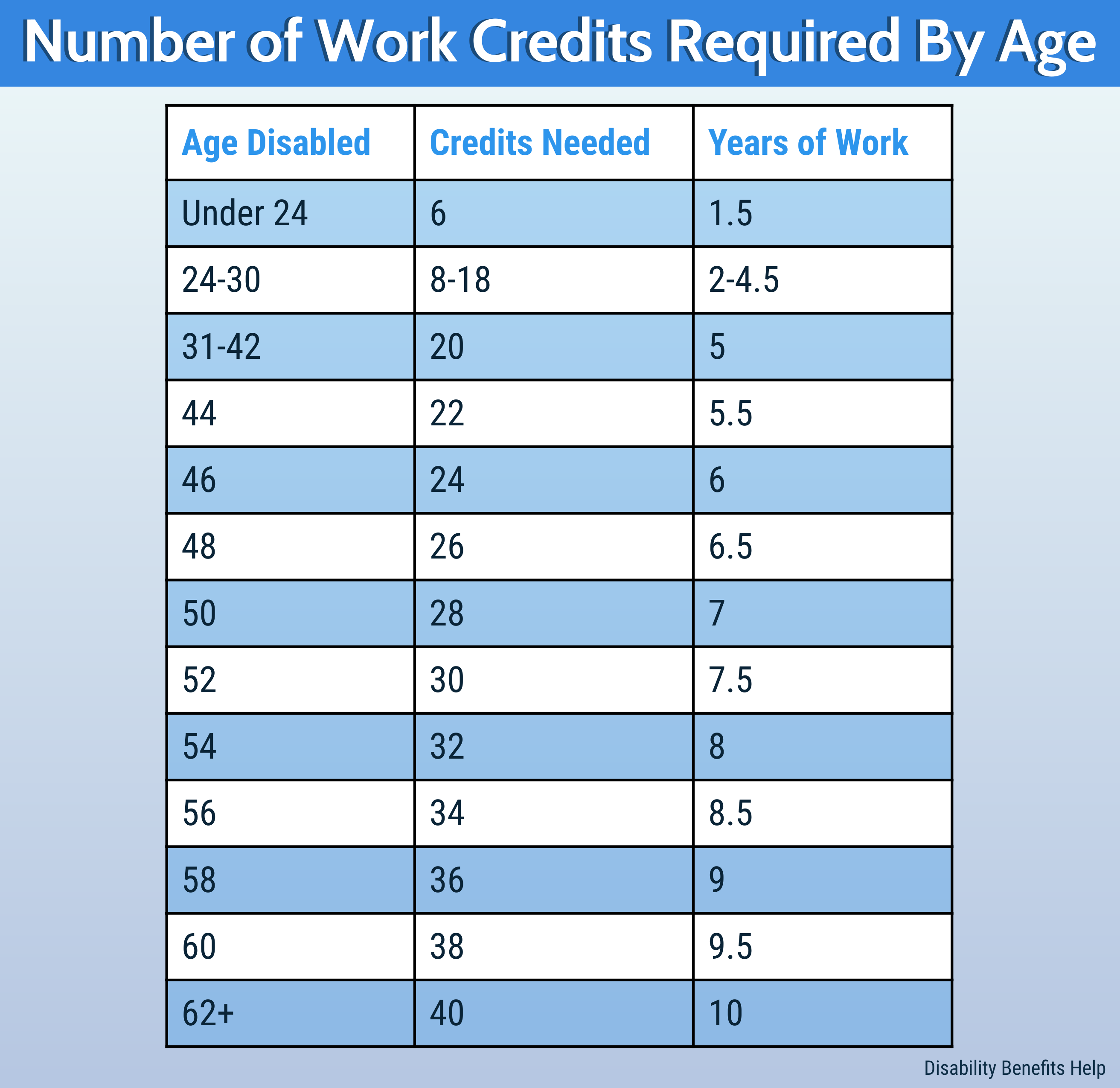

Section 202t11 of the Social Security Act requires that certain non-US. Although 20 quarters is five years and 40 quarters is ten years the legal requirement is based on quarters not years.

Psrs 5 Year Rule Mo Teacher Retirement

Psrs 5 Year Rule Mo Teacher Retirement

/when-and-how-social-security-checks-should-arrive-2388919-v5-5b31507f8e1b6e00369bd83d-a2c1fa784cb04df3aa427f4206745d71.png) What Day Should My Social Security Payment Arrive

What Day Should My Social Security Payment Arrive

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

Labor Supply Responses To Marginal Social Security Benefits

Labor Supply Responses To Marginal Social Security Benefits

When Should You Take Social Security Charles Schwab

When Should You Take Social Security Charles Schwab

Chapter 20 Social Security Reading Essential Reading Hindriks

Chapter 20 Social Security Reading Essential Reading Hindriks

How Long Do You Need To Work To Collect Social Security

How Long Do You Need To Work To Collect Social Security

/social-security-survivor-benefits-for-a-spouse-2388918-v3-5bc644f846e0fb0026f5c3e2.png) Social Security Survivor Benefits For A Spouse

Social Security Survivor Benefits For A Spouse

Social Security Disability Benefits Guide Hill Ponton P A

Social Security Disability Benefits Guide Hill Ponton P A

Social Security United States Wikipedia

Social Security United States Wikipedia

Social Security Disability Benefits Guide Hill Ponton P A

Social Security Disability Benefits Guide Hill Ponton P A

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

How Long Do I Have To Work To Qualify For Disability

How Long Do I Have To Work To Qualify For Disability

Comments

Post a Comment