For example an employee who earns 50000 annually and contributes 5. The other huge benefit of the 401 k is that it allows you to put a lot of money away for retirement in a tax-advantaged way.

How Much Should Be In Your 401 K At 30

How Much Should Be In Your 401 K At 30

Stillthats 6000 extra dollars into your account.

How much money can you put in a 401k. 5500 for both a traditional and a Roth IRA. If youre age 50 and older you can add an. Those 50 or older can contribute an additional 6500.

For 2021 the IRS says you can contribute up to 57000 in your self-employed 401k plan. In 2016 if you are under 50 years old you can contribute a maximum of 18000. In 2020 employees who participate in an employer-sponsored plan.

If youre at least age 50 then you can make an additional 6000 catch-up contribution which increases your limit to 62000. Workers age 50 and older can contribute an additional 6500 in 2021. The annual contribution limits are higher for a 401 k than an IRA at 18000 vs.

The maximum amount workers can contribute to a 401k for 2020 is 500 higher than it was in 2019its now up to 19500 if youre younger than age 50. Last week the IRS announced that 401 k contribution limits will increase by 500. There are annual limits.

For example if youre 50 or older earn a 100000 salary and contribute the maximum 26000 to a 401k your gross income will decrease to 74000. In 2020 and 2021 the most you can contribute to a 401 k is 19500. Contribution limits for 2020 the IRS permits a maximum pre-tax or Roth employee contribution of 19500 with an additional 6500 catch-up contribution for individuals who are age 50 or older at any time during the year.

Investing in your 401k can also result in big tax savings. If youre 50 or older you can make an additional catch-up contribution of as much as. If you dont have a Roth 401 k option a good rule of thumb is to put just enough money into your traditional 401 k to get the company match and then to put any additional savings into a Roth IRA.

58000 total annual 401 k if you are age 49 or younger 64500 total annual 401 k if you are age 50 or older The dollar amounts listed above represent the total maximum amount that can be contributed as a combination of both your own and your employers contributions. The 401 k contribution limit is 19500 in 2021. For 2020 the maximum you can save in a 401 k is 19500.

Other Benefits of a 401k. The annual contribution limit is 19500 for tax year 2020 with an. Individuals 50 years of age and older are allowed to make an additional catch up contribution on top of the regular 401 k limit.

The 2020 and 2021 contribution limits for your 401 ks are 19500. It is common for the total to stay the same or just increase slightly depending on economic conditions. Pre-tax contributions are beneficial because they lower your taxable income and allow you to build the value of your 401 k account more quickly.

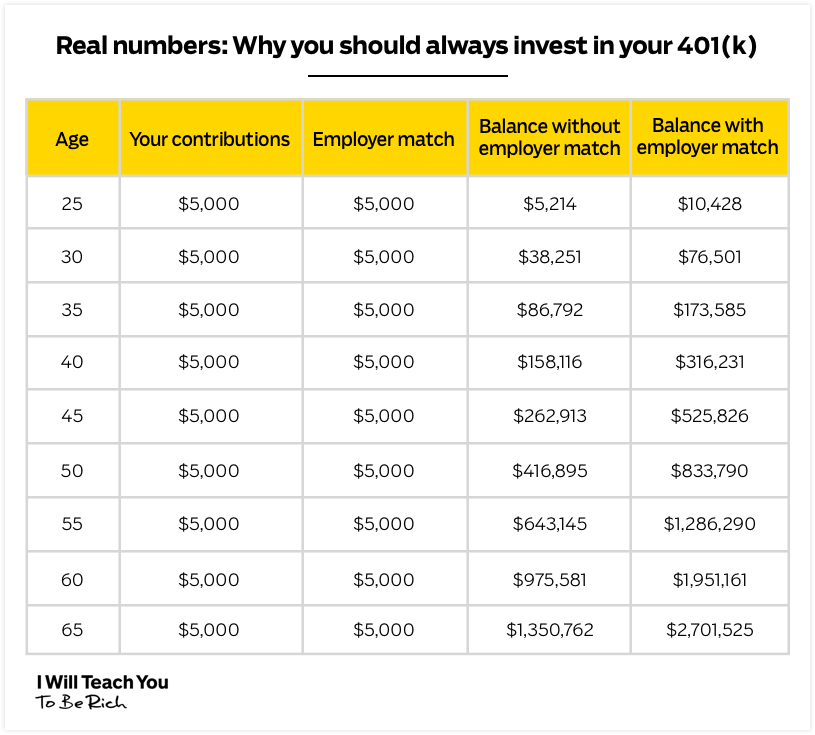

Youre limited to the same amount that youre allowed to contribute to other 401k plans 18500 as of 2018. If youre wondering how much money you should have in your 401k your wait is over. A 401k calculator can help you see how these matching contributions or larger yearly contributions can impact your retirement savings.

Qualifying for a 401 k match is the fastest way to build wealth for. This limit applies across all of your 401k accounts which means that the total amount of your employee contribution is limited to 18500 total between any 401k accounts that you might have. For 2020 this total is 6500.

That limit increases to 26000 if youre 50 or older. Nothing to sneeze at. Dont forget the match.

How much can you contribute to a 401 k. Increasing your 401 k contributions can add up. Total contribution limits for 2021 are the following.

So if you contribute 10000 over the course of the year your employer will only match the first 6000. Retirement savings is much of the talk in todays personal finance world. Employer contributions are on.

Your other deductions such as the standard deduction can reduce your taxable income even further. The amount should go up by 500 1000 every one or two years. Personal finance specialists everywhere are sounding off about the dire straits of the average Joes retirement savings situation.

/what-does-it-mean-to-be-vested-in-my-401-k-2385773-v2-5bbe03414cedfd0026d7f4a4.png) What Does It Mean To Be Vested In My 401 K

What Does It Mean To Be Vested In My 401 K

You Can T Save Too Much In Your 401 K For Retirement

You Can T Save Too Much In Your 401 K For Retirement

401 K Calculator Will You Have Enough To Retire Smartasset

401 K Calculator Will You Have Enough To Retire Smartasset

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

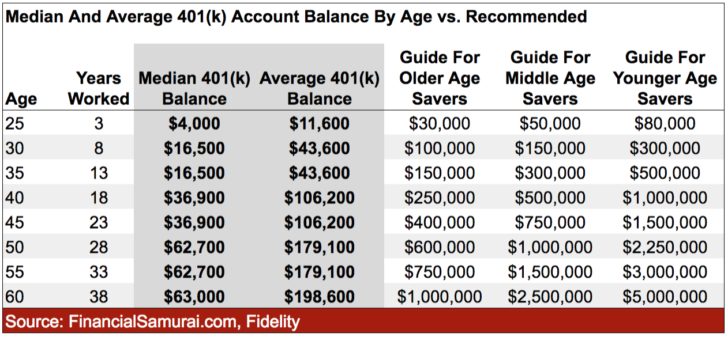

How Much Should I Have In My 401k During My 20 S 30 S 40 S And 50 S

How Much Should I Have In My 401k During My 20 S 30 S 40 S And 50 S

401k Savings By Age How Much Should You Save For Retirement

401k Savings By Age How Much Should You Save For Retirement

Investing For Beginners A Quick And Easy Guide To Investment

Investing For Beginners A Quick And Easy Guide To Investment

What If You Always Maxed Out Your 401 K Dqydj

What If You Always Maxed Out Your 401 K Dqydj

How Much Should You Contribute To Your 401 K

How Much Should You Contribute To Your 401 K

This Is What Happens To Your 401 K When You Quit Mintlife Blog

This Is What Happens To Your 401 K When You Quit Mintlife Blog

:strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif) 2021 401 K Contribution Limits Rules And More

2021 401 K Contribution Limits Rules And More

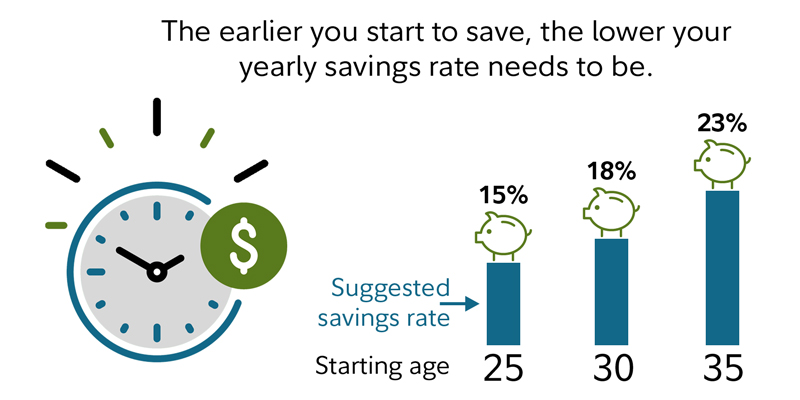

How Much Money Should I Save Each Year For Retirement Fidelity

How Much Money Should I Save Each Year For Retirement Fidelity

How Much Should You Contribute To Your 401 K

How Much Should You Contribute To Your 401 K

Comments

Post a Comment