In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. The federal corporate income tax.

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

The actual rates didnt change for 2020 but the income brackets did adjust slightly.

Stock tax bracket. There are seven tax brackets for most ordinary income. Long-term capital gains are gains on assets you hold for more than one year. That means you pay the same tax rates you pay on federal income tax.

Preparing for Your Tax Bill. Here is a simple capital gains calculator to help you see what effects the current rates will have in your own life. Short term gains on stock investments are taxed at your regular tax rate.

If you held an investment for less than one year before selling it for a gain that is classified as a short-term capital gain and you pay the. In a progressive individual or corporate income tax system rates rise as income increases. For the federal capital gains tax rate it depends on an investors.

Theyre taxed at lower rates than short-term capital gains. How much these gains are taxed depends a lot on how long you held the asset before selling. Long-term capital gains taxes.

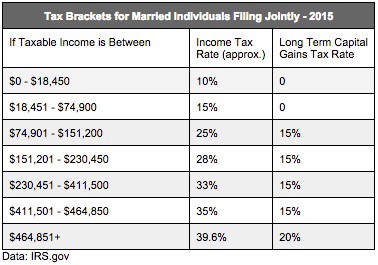

Part of your 10000 capital gainthe portion up to the 85525 limit for the bracketwould be taxed at 22. Has a progressive tax system which means that as you move up the pay scale you also move up the tax scale. They are taxed at rates of 0 15 or 20 depending on the investors taxable income but these rates are generally lower than the corresponding tax brackets for all income levels.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Tax brackets result in a progressive tax system in which taxation progressively increases as. From YA 2017 the tax rates for non-resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

Theyre taxed like regular income. The remaining 4475 of the gain however would be taxed at 24 the rate for the. Anything above that is.

Short-Term Capital Gains Rates Tax rates for short-term gains are 10 12 22 24 32 35 and 37. Long term gains are taxed at 15 for most tax brackets and zero for the lowest two. 10 12 22 24 32 35 and 37.

Tax brackets for long-term capital gains investments held for more than one year are 15 and 20. This fund doesnt shelter income from state taxes. The highest of the tax brackets is for anyone making more than 510300 a year in taxable income.

Keep in mind that your tax bracket may go up because of your stock market profits. An additional 38 bump applies to filers with higher modified adjusted gross incomes MAGI. When you sell stocks for a profit it is important to set aside the money you will need to cover your tax bill.

Short-term gains are for assets held for one year or less - this includes short term stock holdings and short term collectibles. A tax bracket is the range of incomes taxed at given rates which typically differ depending on filing status. This is to maintain parity between the tax rates of non-resident individuals and the top marginal tax rate of resident individuals.

There are seven federal tax brackets for the 2020 tax year. Depending on your overall income tax bracket stock sales are taxed at a rate of either zero 15 20 or 238 percent Blain says. Capital gains are included in your adjusted gross income for tax purposes.

Lets say Jamie starts a new job and is trying to figure out how much she will. The fund has a low expense ratio of 008 and the current 161 tax-free yield is equivalent to a 2236 taxable yield for someone in the 245 tax bracket. There are seven federal individual income tax brackets.

Tax rates range from 10 to 37 and the income thresholds for each bracket vary based on your filing status single married filing jointly married filing separately or head of household. That bracket pays a tax rate of 10. A tax bracket refers to a range of incomes subject to a certain income tax rate.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Your bracket depends on your taxable income and.

Moving Your Company S Stock Tax Efficiently Net Unrealized Appreciation

Moving Your Company S Stock Tax Efficiently Net Unrealized Appreciation

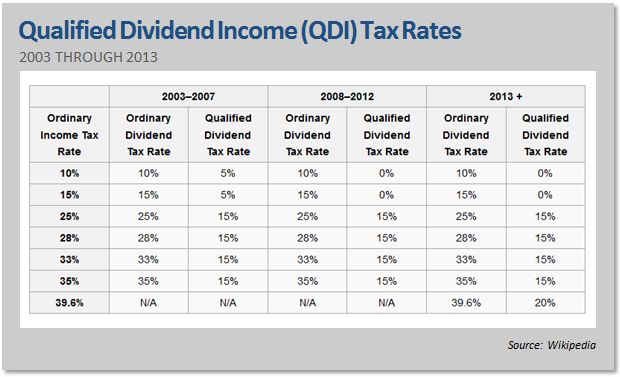

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

Mechanics Of The 0 Long Term Capital Gains Rate

Mechanics Of The 0 Long Term Capital Gains Rate

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Here S How The New Us Tax Brackets For 2019 Affect Every American Taxpayer Markets Insider

Here S How The New Us Tax Brackets For 2019 Affect Every American Taxpayer Markets Insider

2021 Tax Brackets How They Actually Work White Coat Investor

2021 Tax Brackets How They Actually Work White Coat Investor

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works Hacker Noon

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works Hacker Noon

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

Long Term Capital Gain Tax Stock Page 7 Line 17qq Com

Long Term Capital Gain Tax Stock Page 7 Line 17qq Com

What S Your Tax Rate For Crypto Capital Gains

What S Your Tax Rate For Crypto Capital Gains

The Tax Impact Of The Long Term Capital Gains Bump Zone

The Tax Impact Of The Long Term Capital Gains Bump Zone

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Comments

Post a Comment