Those who collected over 10200 in unemployment income in 2020 will still owe taxes on the amount over that threshold meaning some could still owe money to. Because the change occurred after some people filed their taxes the IRS will take steps in the spring and summer to make the appropriate change to their return which may result in a refund.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Without this new tax exemption many people who claimed unemployment benefits in 2020 could have faced an unwelcome tax bill.

Do i claim unemployment on my taxes. Your benefits may even raise you into a higher income tax bracket though you shouldnt worry too much about getting into a higher tax bracket. If you received unemployment benefits in 2020 it counts as part of your income and thus you will owe income taxes on that amount. You can claim your unemployment-benefits tax waiver in your 2020 income tax return.

Unemployment benefits are like wages and you must report it as income on your tax return if you earned enough income to need to file taxes. Others never do and still others have different rules entirely. The first refunds are expected to be made in May and will continue into the summer.

The new tax break is an exclusion workers exclude up to 10200. Be sure to check your states official website for more information. Unemployment benefits are generally treated as income for tax purposes.

Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The legislation excludes only 2020 unemployment benefits from taxes. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200.

How to Claim Your 10200 Unemployment Tax Break If You Already Filed Taxes Tax experts often advise taxpayers to file their taxes early to expedite their refund or to be in a better position to. While the ARP allows 10200 of unemployment compensation received in 2020 to be tax-free unemployment benefits received in 2021 remain taxable on the return youll file in 2022 unless some future relief measure is enacted. It makes sense to withhold tax upfront to avoid surprises.

Here are some of. Yes unemployment checks are taxable income. Normally all unemployment income is taxable at the federal level but the new relief bill exempts jobless workers first 10200 in benefits for those earning less than 150000.

Amounts over 10200 for each individual are still taxable. Unemployment benefits are usually taxable as income and are still subject to federal income taxes above the exclusion or if you earned more than 150000 in 2020. Some states always provide tax-free unemployment benefits.

If your modified AGI is 150000 or more you cant exclude any unemployment compensation. If you received more than 10200 in unemployment benefits that will be taxed. Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return.

At tax time states mail Form 1099-G Certain Government Payments to the address associated with a claim or make the form available online so the taxpayer can report the income on their tax. To do so youll need the information in your Form 1099-G which shows how much you received in unemployment. BUT the first 10200 of unemployment benefits you received is not taxable by the IRS.

Instead of paying taxes on the full amount of unemployment benefits the government is allowing eligible taxpayers to treat up to 10200 of their benefits as tax-free income. Remember to keep all of your forms including any. Generally unemployment benefits are.

The amount will be carried to the main Form 1040. This tax break will be welcome. While unemployment compensation was retroactively made tax-free on the federal level your state may not conform to the federal rules.

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Are Unemployment Benefits Income Taxable Compensation Mint

Are Unemployment Benefits Income Taxable Compensation Mint

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

How To Claim Your Unemployment Tax Break On 2020 Benefits

How To Claim Your Unemployment Tax Break On 2020 Benefits

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Year End Tax Information Applicants Unemployment Insurance Minnesota

Year End Tax Information Applicants Unemployment Insurance Minnesota

Taxes Q A How Do I File If I Only Received Unemployment

Taxes Q A How Do I File If I Only Received Unemployment

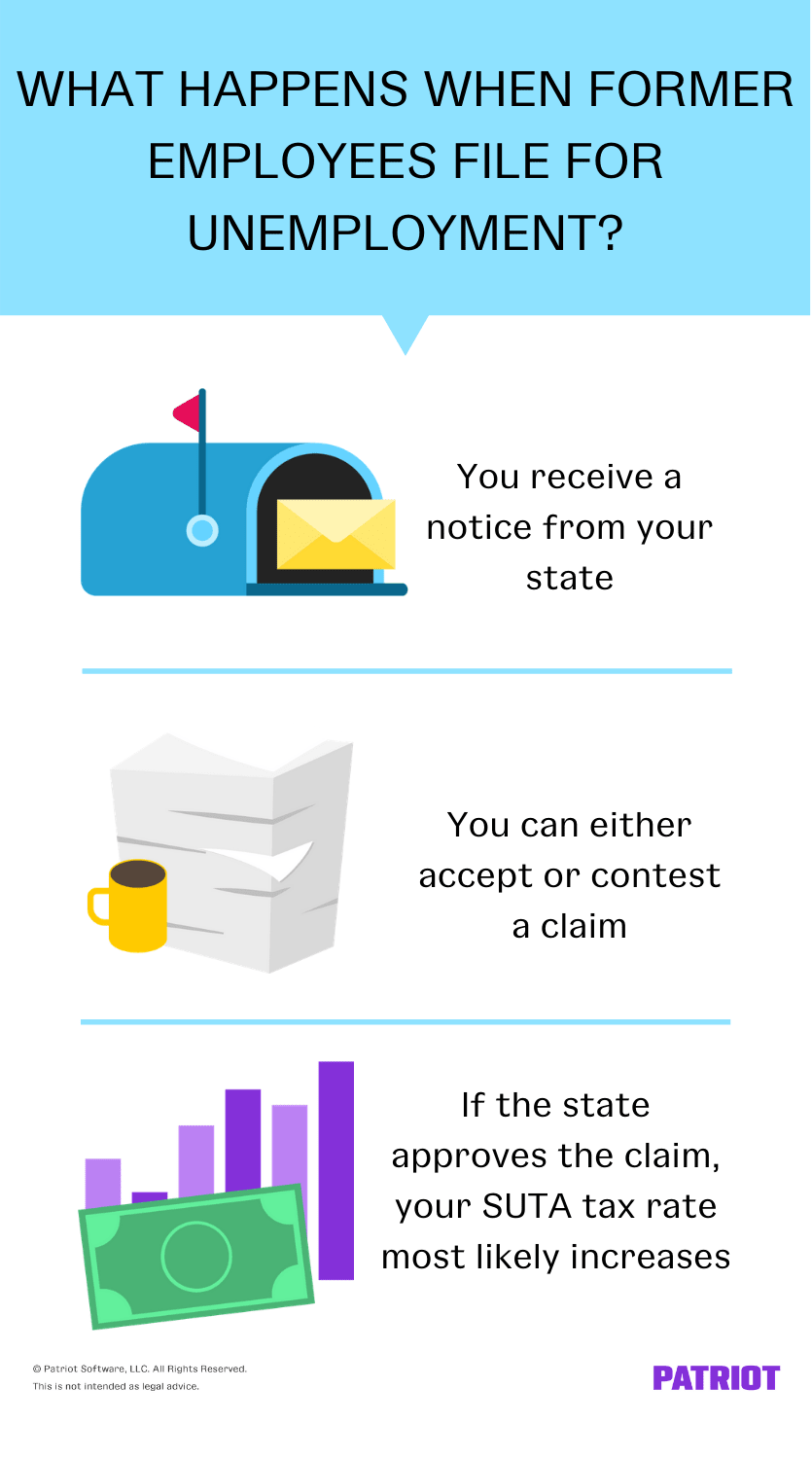

How Does Unemployment Work For Employers Handling Claims

How Does Unemployment Work For Employers Handling Claims

Comments

Post a Comment