While predicting when the next recession or. Growth Stocks vs.

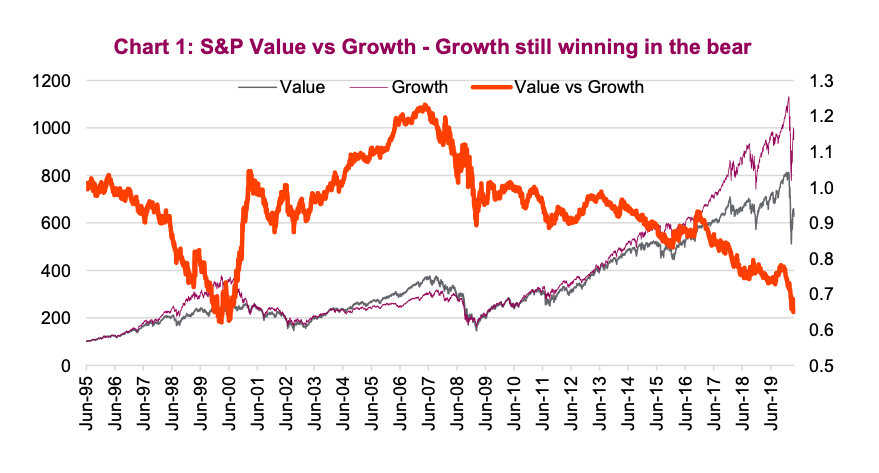

Bear Market Hits Value Stocks And Small Caps See It Market

Bear Market Hits Value Stocks And Small Caps See It Market

Naturally this is a positive for commodity producers like oil companies.

Value growth stocks. Theres a longstanding debate as. Growth stocks debate is never-ending but recent advances from value companies are signaling a significant tide change. Growth stocks on the other hand tend to reinvest every dollar they make into their business growth.

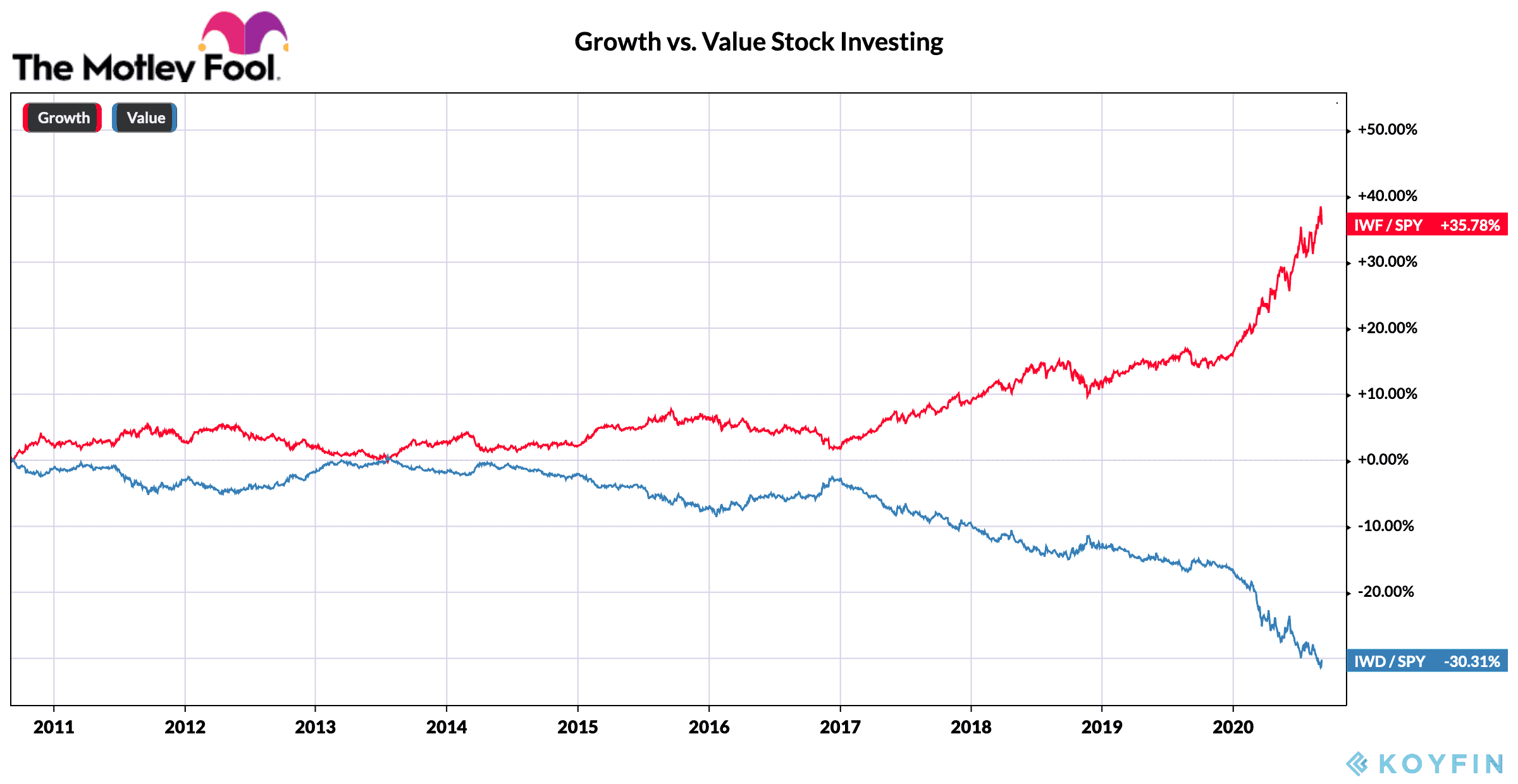

My definition of a fast grower growth stock is one that has consistently compounded earnings at 15 per annum or better over extended periods of. An investor rotation away from growth stocks in favor of value stocks certainly seems to be underway. Growth stocks might be volatile and not grow and value stocks might not gain momentum and suffer a collapse.

Ad Buat prediksi dan lihat hasilnya dalam 1 menit. For example Morningstar MORN defines growth stocks as those. Value investors seek to profit as the price returns to its fair value while growth investors are looking for.

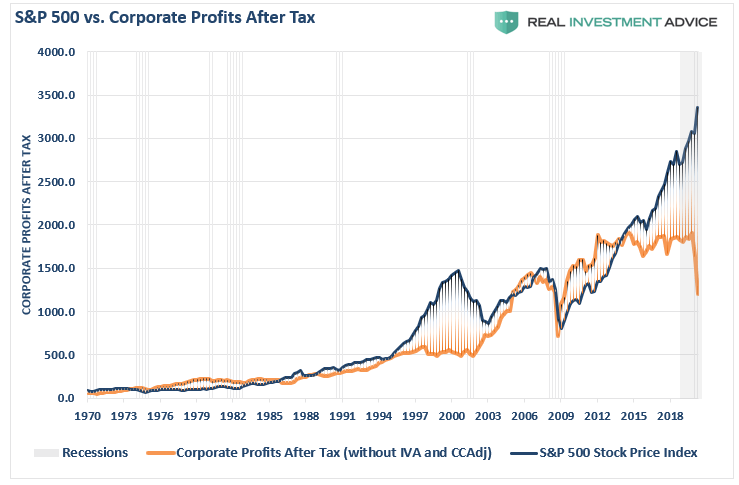

From the March downturn through the end of. Many managers of these blended funds pursue a strategy known as growth at a reasonable price GARP focusing on growth companies but with a keen awareness of traditional value indicators. Valuation metrics such as PE priceearnings or PEG priceearnings to growth can be completely useless - even on a forward basis - if you are looking at a.

Growth and value defined Growth stocks represent companies that have demonstrated better-than-average gains in earnings in recent years and that are expected to continue delivering high levels of profit growth although there are no guarantees. Growth stocks are those stocks expected to grow faster than the average stock. T he value vs.

Coba strategi Anda dengan perdagangan kecil mulai dari 1. Choosing the right one is not solely dependent upon the ratios or past financial performance. Value Stocks vs Growth Stocks.

Pengaturan trading yang fleksibel. One study by JP. Value stocks are typically considered to carry less risk than growth stocks because they are usually those of larger more-established companies.

Value and growth investing are opposing strategies. Bonus sambutan untuk pemula. There are blended funds created by portfolio managers that invest in both growth stocks and value stocks.

Coba strategi Anda dengan perdagangan kecil mulai dari 1. If it does catch up over the next four years value stocks should gain 40 percentage points more than growth shares gain. Being able to borrow money and sell corporate bonds at low interest rates is great for tech.

Ad Buat prediksi dan lihat hasilnya dalam 1 menit. Value vs Growth stocks Usually value stocks represent solid and robust companies that use the money they earn to distribute consistent and rising dividends which provide more secure and regular revenues for investors. Bonus sambutan untuk pemula.

Style is one factor size is the other. A stock prized by a value investor might be considered worthless by a growth investor and vice versa. Pengaturan trading yang fleksibel.

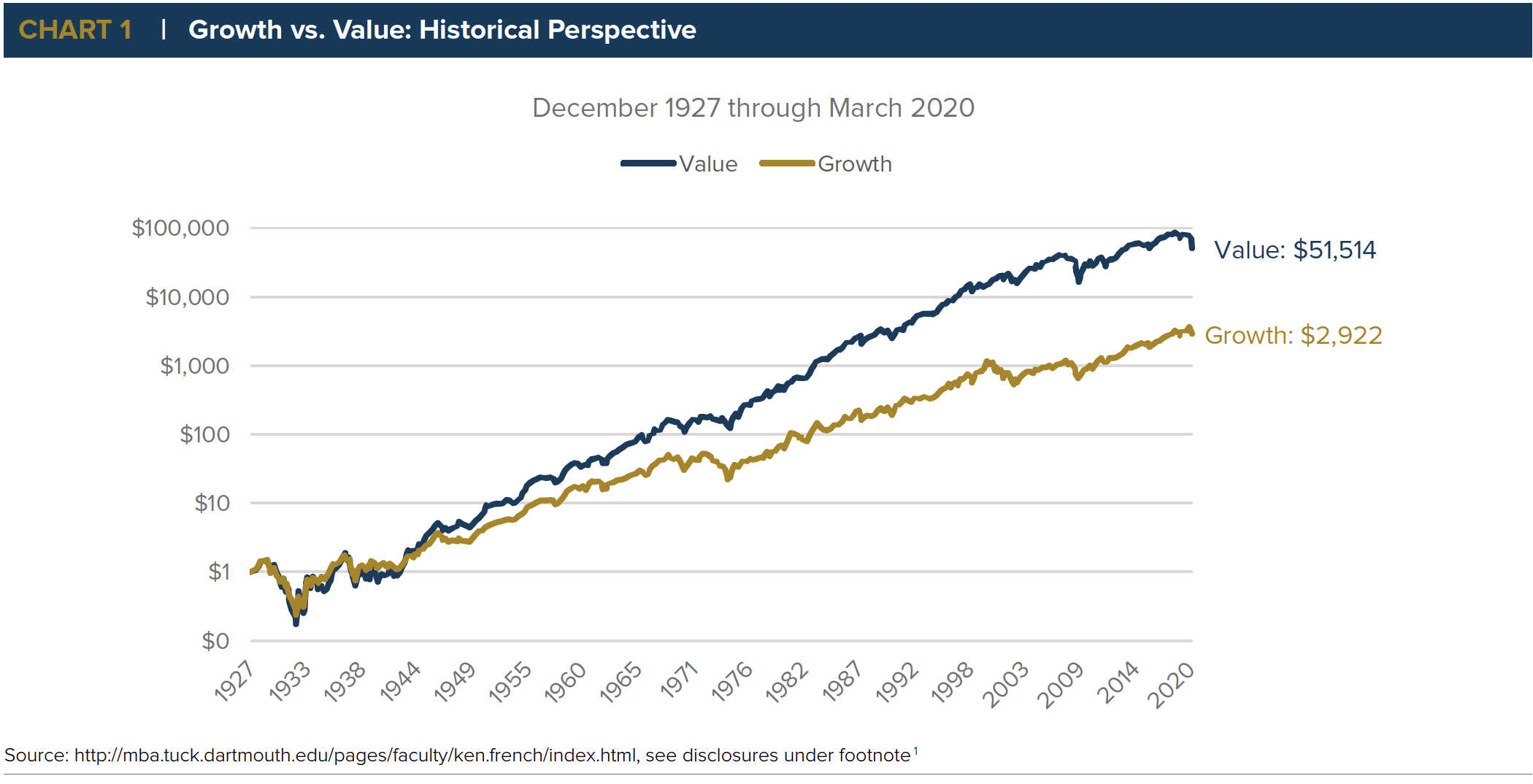

Morgan concluded that value stocks could outperform growth stocks in a recession or if inflation and interest rates rise. Value stocks may finally shine in 2021. Value investing alongside growth investing is one of two basic strategies investors often choose to deploy in their portfolios.

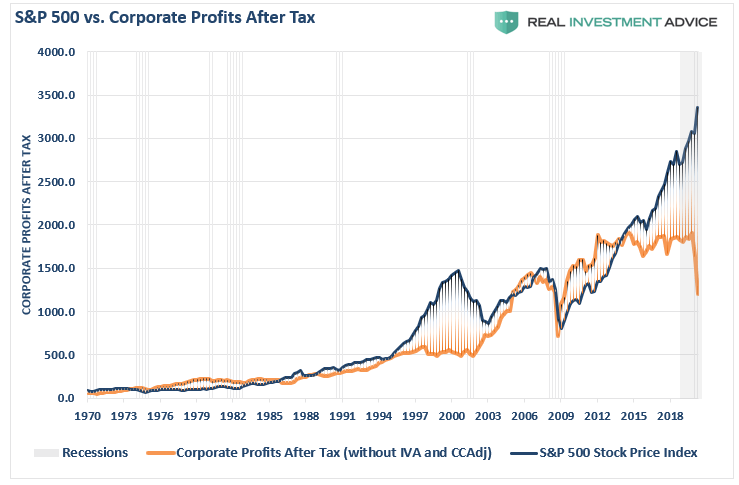

Both growth and value stocks come with different risks. Value Stocks The concept of a growth stock versus one that is considered to be undervalued generally comes from the fundamental stock analysis. Growth stocks once again outshone value stocks in 2020 a theme that has played out throughout most of the past decade.

Growth stocks are considered by.

Growth Stocks Vs Value Stocks Overview Features Differences

Growth Stocks Vs Value Stocks Overview Features Differences

Is The Tide About To Change Value Stocks Vs Growth Stocks Fourth Dimension Financial Group

Is The Tide About To Change Value Stocks Vs Growth Stocks Fourth Dimension Financial Group

Growth Stock Vs Value Stock 6 Best Differences With Infographics

Growth Stock Vs Value Stock 6 Best Differences With Infographics

Value Vs Growth Stocks Value Investing Death Exaggerated But How Much Investor S Business Daily

Value Vs Growth Stocks Value Investing Death Exaggerated But How Much Investor S Business Daily

Is It Time For Value Stocks To Shine

Is It Time For Value Stocks To Shine

Value Stocks Versus Growth Stocks Difference Between

Value Stocks Vs Growth Stocks In 2020 Return On Time

Value Stocks Vs Growth Stocks In 2020 Return On Time

Growth Stocks Vs Value Stocks Volition Financial Network Financial Advising Firm

Growth Stocks Vs Value Stocks Volition Financial Network Financial Advising Firm

Better Buy Growth Or Value Stocks For The Next 10 Years The Motley Fool Canada

Better Buy Growth Or Value Stocks For The Next 10 Years The Motley Fool Canada

Is It Time For Value Stocks To Shine Franklin Templeton

Is It Time For Value Stocks To Shine Franklin Templeton

Relative Performance Of Growth Vs Value Stocks Validea S Guru Investor Blog

Relative Performance Of Growth Vs Value Stocks Validea S Guru Investor Blog

Growth Versus Value Investing In A Covid 19 World Rbc Wealth Management

Growth Versus Value Investing In A Covid 19 World Rbc Wealth Management

Value Vs Growth Stocks Which Method To Choose

Value Vs Growth Stocks Which Method To Choose

Growth Vs Value Historical Perspective Anchor Capital Advisors

Growth Vs Value Historical Perspective Anchor Capital Advisors

Comments

Post a Comment