For your 2020 taxes which youll file in early 2021 only individuals making more than 1077550 pay the top rate and earners in the next bracket. Hold Your Spot Pay Later.

Income Tax Hike Looming For Ny Empire Center For Public Policy

2021 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

New york income tax brackets. The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. It is based on New York taxable income and the following bracket rates apply. The values of these deductions for tax year 2018 are as follows.

New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Compare the Best Tours and Attractions Now. New York state income tax brackets and income.

Ad Hadromi Partners is one of the prominent law firms in Indonesia. New York has 8 tax brackets each with its own tax rate. 24 Hour Cancellation Policy Available.

NYS taxable income LESS than 65000. New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount. New York uses a bracketed system in which tax rates increase as income rises.

Hold Your Spot Pay Later. Your average tax rate is 222 and your marginal tax rate is 360This marginal tax rate means that your immediate additional income will be taxed at this rate. Compare the Best Tours and Attractions Now.

Critically credits dont reduce the surcharge. So taxpayers with huge nonrefundable investment tax credits or brownfield tax credits or movie production credits will still need to pay the surcharge and carry over the unused credits to subsequent years. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

New York Income Taxes. Part-year NYC resident tax. NYS taxable income 65000 or MORE.

Where you fall within these brackets depends on your filing status and how much you earn annually. The state applies taxes progressively as does the federal government with higher earners paying higher rates. Ad Hadromi Partners is one of the prominent law firms in Indonesia.

New York City has four separate income tax brackets that range from 3078 to 3876. New York state income tax rates are 4 45 525 59 609 641 685 and 882. NYS adjusted gross income is MORE than 107650.

Ad Discover Everything New York City has to Offer. Ad Discover Everything New York City has to Offer. New York City Resident Tax.

New York Tax Rates. New York City Income Tax Rates New York City has four tax brackets ranging from 3078 to 3876. Rates kick in at different income levels depending on your filing status.

New Yorks tax rates range from a low of 4 for those with taxable incomes of 17150 or less to 882 for those making 2155350 or more. Married and filing a joint NYS return and one spouse was a. For the 2021 tax season the tax rates are between 4 to 882.

24 Hour Cancellation Policy Available. For single filers up to 8500 is subject to a 4 tax rate while it starts at 17150 for joint filers. If you make 55000 a year living in the region of New York USA you will be taxed 12187That means that your net pay will be 42813 per year or 3568 per month.

The New York tax rate is mostly unchanged from last year. Use the NYS tax computation. Deduction numbers arent available for New York for this tax year.

NYS tax rate schedule. Compared to the federal income tax brackets expect to. NYC tax rate schedule.

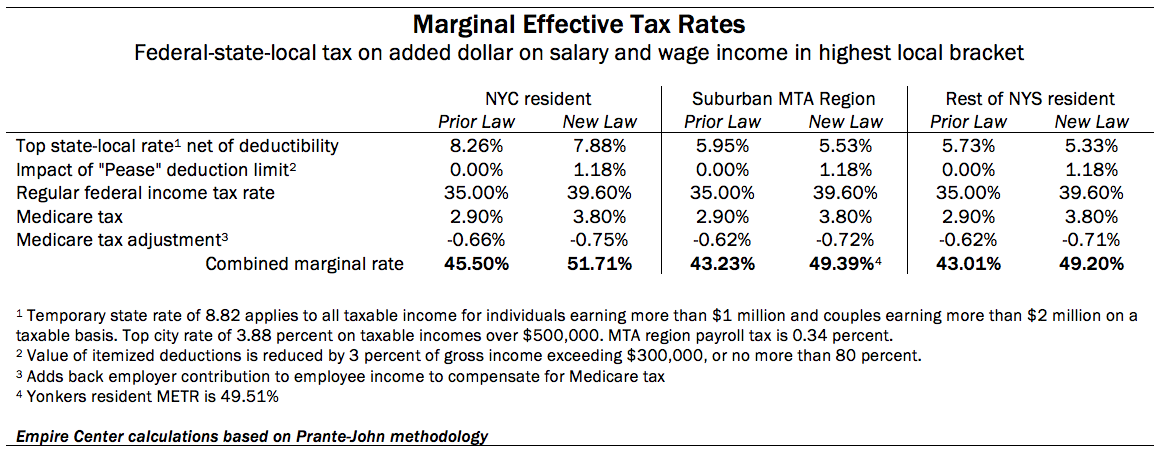

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Annual State Local Tax Burden Ranking 2010 New York Citizens Pay The Most Alaska The Least Tax Foundation

Annual State Local Tax Burden Ranking 2010 New York Citizens Pay The Most Alaska The Least Tax Foundation

Albany Boosts Taxes On Wealthiest Wsj

Albany Boosts Taxes On Wealthiest Wsj

Do States Like New York And California Really Have High Taxes Quora

Https Www Empirecenter Org Wp Content Uploads 2018 04 Rdb Pit Ejm April 2018 Update Pdf

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

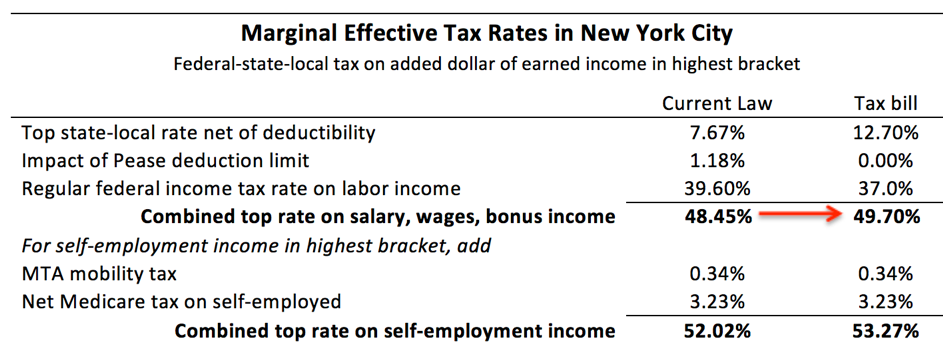

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

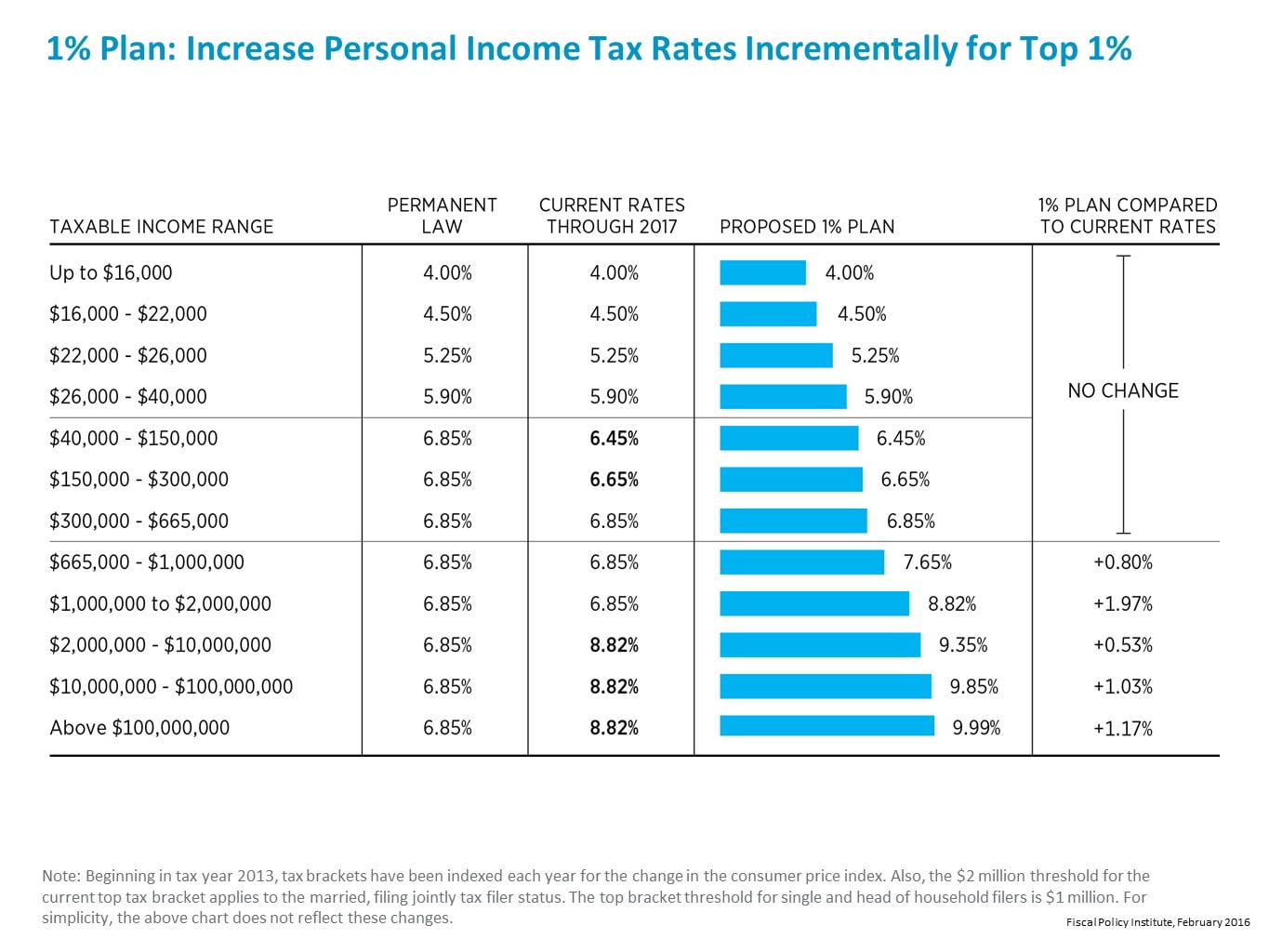

Figures From New York State Economic And Fiscal Outlook 2016 2017 Fiscal Policy Institute

Figures From New York State Economic And Fiscal Outlook 2016 2017 Fiscal Policy Institute

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

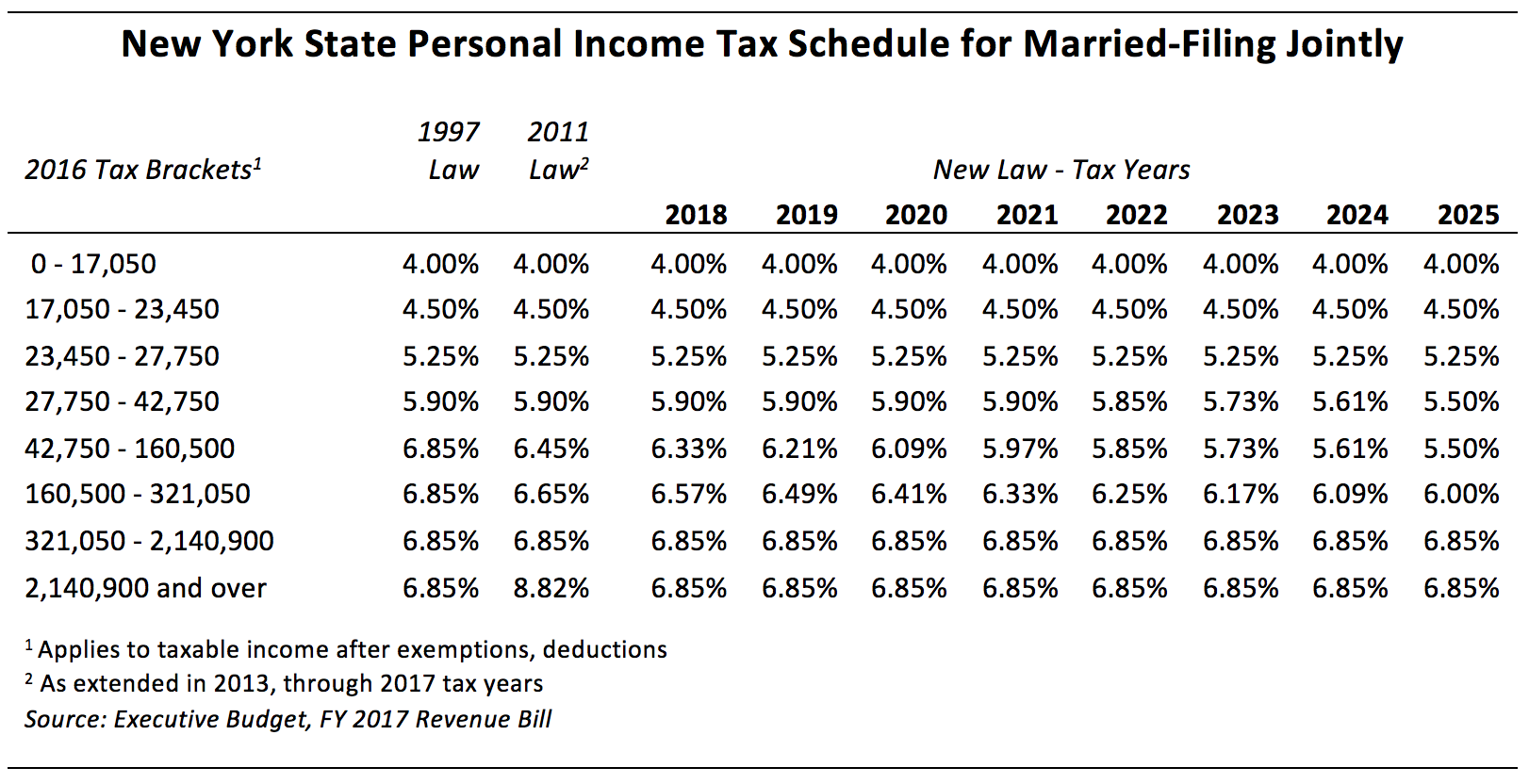

How The Tax Cut Stacks Up Empire Center For Public Policy

How The Tax Cut Stacks Up Empire Center For Public Policy

Comments

Post a Comment