Unfortunately not everyone who wants to buy a home can qualify for a mortgage. Find a local lender on Zillow who can help you find out if youll qualify for a mortgage.

How To Qualify For A Mortgage Sunset Mortgage Of Alabama

How To Qualify For A Mortgage Sunset Mortgage Of Alabama

The answer to this question is dependent on a few factors.

Will i qualify for a home loan. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for including your income the price of the home and your other debts. If you are paid a salary then this should be easy. Department of Veterans Affairs VA makes qualifying for a home loan easier for military borrowers including active-duty personnel reservists veterans and eligible surviving spouses.

This calculator should be used for estimation purposes only. The most common way for retirees to get a mortgage is by qualifying based on income said certified financial planner Daniel Graff a principal and client advisor at Sullivan Bruyette Speros. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses.

You are better qualified for a home loan if you have a 50 percent down payment. This means you have to pay for private mortgage insurance PMI. If your income is less than or equal to 100 of your areas median income you may qualify for a HomeReady or Home Possible loan.

The VA removed loan limits which means VA borrowers may be able to buy higher-priced homes. Fannie Freddie and Ginnie Most conventional loans in the United States are owned by or insured by the government-sponsored enterprises Fannie Mae Freddie Mac or Ginnie Mae. These monthly expenses include property taxes PMI association dues insurance and credit card payments.

You should have at least 2 years of documented income from the same company or in the same industry to qualify. Thats because lenders try to make certain youll pay back your debt before they allow you. Input these values into our mortgage qualifying calculator and it will bring out the maximum purchase price you can qualify for.

Find Out if You Qualify for a Mortgage. Assess how much you could save by moving your bond to SA Home Loans access cash consolidate debt and improve your monthly cash flow. From a lenders perspective borrowers who contribute a higher amount of their own money to a.

Lenders examine your debt-to-income ratio credit score and current income to see if you qualify for a home loan. To qualify for a home loan you will need to prove your income is sufficient and consistent. To see if youd qualify for a mortgage you can talk to a local lender submit an anonymous loan request on Zillow or use our Affordability Calculator.

Many first-time buyers are unaware that simply having the available funds does not grant instant access to a home loan. You may qualify for a loan amount of 252720 and your total monthly mortgage payment will be 1587. Try to get them up to the required minimum before you apply for a home loan.

If youd like to take out a new bond on your existing bond-free home in order to access cash out of the property use this calculator to see what your expected repayment would be. Home Loan eligibility is dependent on factors such as your monthly income current age credit score fixed monthly financial obligations credit history retirement age etc. The most notable of the factors is your annual income and the loan term.

However self-employed borrowers and commission-based jobs are more difficult. You must show a year of on-time bankruptcy plan payments to qualify for a VA home loan and you must obtain bankruptcy court approval. These conventional loans have some extra perks such as.

To qualify at most financial institutions the main applicant will need to have a life insurance policy with some institutions even going so far as to specify additional disability cover says Goslett. Alternative options to prove creditworthiness if you have no credit score. Yes it is still possible to apply for a home loan with your current residency status.

Get the peace of mind by knowing all the details about your loan using HDFC Home Loan Eligibility Calculator Calculate Home Loan Eligibility Gross Income Monthly Rs. It is best to pay attention to these details. How-to instructions you can trust.

Since your cash on hand is 55000 thats less than 20 of the homes price. How much mortgage might I qualify for.

What Type Of Credit Score Will Help You Qualify For A Mortgage Myhorizon

What Type Of Credit Score Will Help You Qualify For A Mortgage Myhorizon

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg) 5 Things You Need To Be Pre Approved For A Mortgage

5 Things You Need To Be Pre Approved For A Mortgage

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Qualify For Mortgage The Basics

Qualify For Mortgage The Basics

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

7 Steps To Get A Home Loan In Wa Or Co Id

7 Steps To Get A Home Loan In Wa Or Co Id

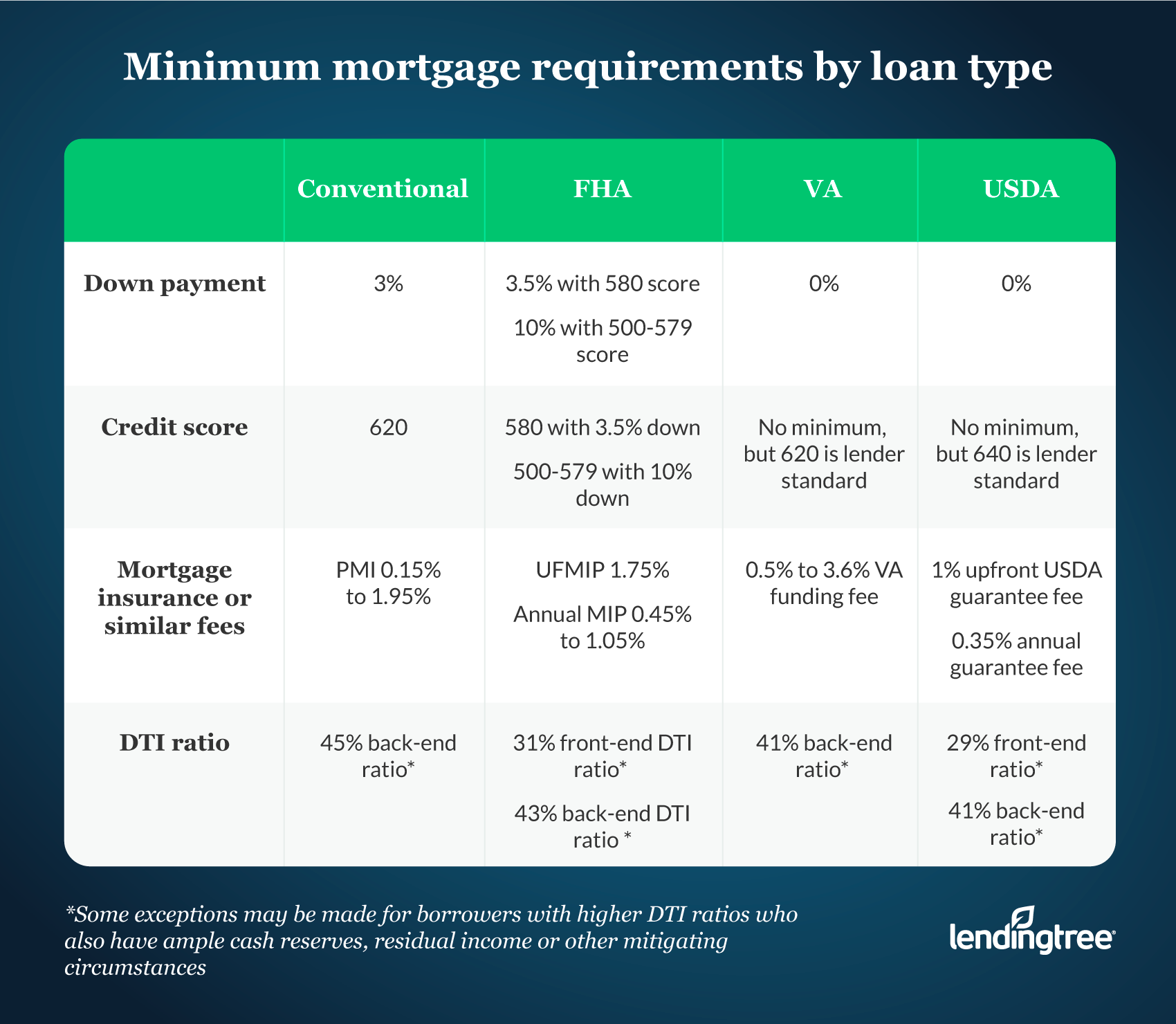

2021 Minimum Mortgage Requirements Lendingtree

2021 Minimum Mortgage Requirements Lendingtree

Home Loan Eligibility Housing Loan Eligibility Calculator Eligibility Criteria

Home Loan Eligibility Housing Loan Eligibility Calculator Eligibility Criteria

What Do You Need To Qualify For A Home Loan The Cameron Team Home Buying Tips Real Estate Advice Home Loans

What Do You Need To Qualify For A Home Loan The Cameron Team Home Buying Tips Real Estate Advice Home Loans

Comments

Post a Comment