But there are some exceptions. Since most of the money distributed to a beneficiary as a death benefit is tax free a life insurance policy becomes a way to leave your family a nest egg without any tax implications attached.

Are Life Insurance Proceeds Taxable Cases In Which Life Insurance Is Taxed Valuepenguin

Life insurance proceeds arent taxable.

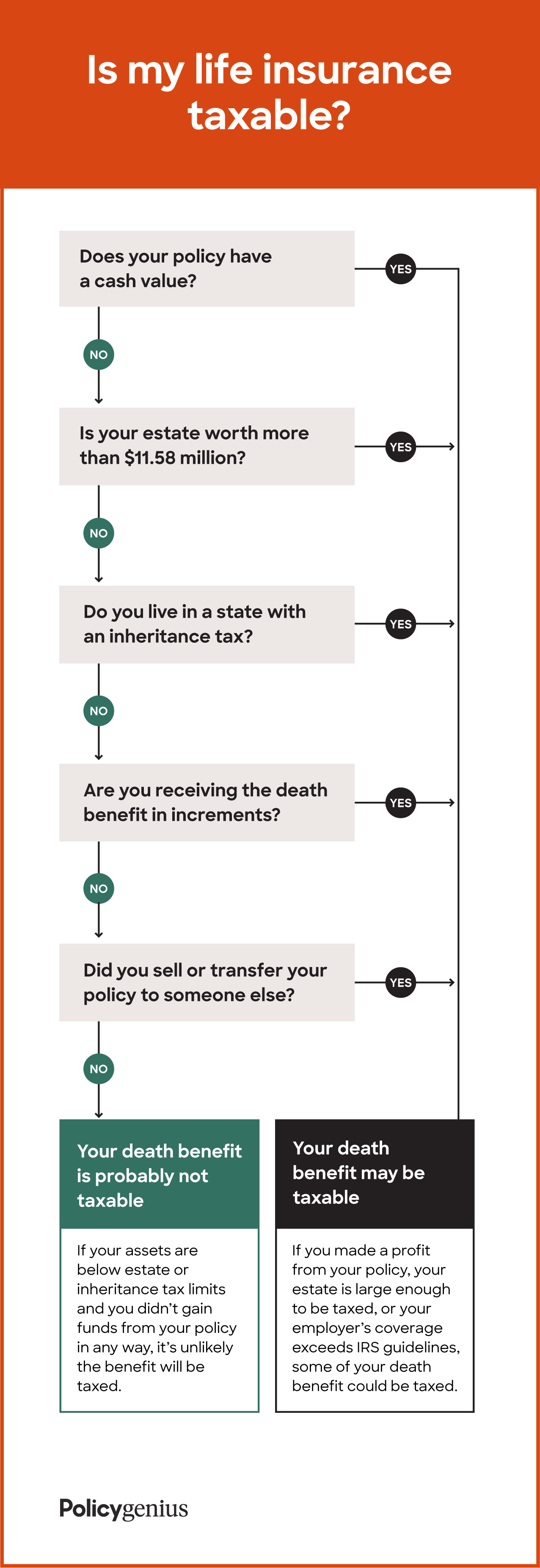

Is life insurance money taxable. However you or your beneficiary might be subject to estate taxes inheritance taxes gift taxes or the generation-skipping transfer tax. But there are times when money from a policy is taxable especially if youre accessing cash value in. If youre the beneficiary of a life insurance policy the IRS says you dont have to report the amount received as income when you file taxes.

If you have employer-provided life insurance known as group life insurance any coverage over 50000 is treated as taxable income but any amount under 50000 is not taxed. Any monetary gifts above 15000 are taxable. Life insurance proceeds are typically not taxable as income but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

You may face income and capital gains taxes if you decide to get rid of your policy through a life insurance settlement or by surrendering it to your insurer. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. The date-of-death value of life insurance proceeds is not taxable to the beneficiary.

While life insurance payouts are not treated as taxable income there are some scenarios where you will need to pay taxes on related funds. Delayed payouts could be taxable if the payout earned interest during the delay. Provisions of section 80C offer the income tax deduction whereas provisions of section 1010D provides the income tax exemption.

When a life insurance policy pays out money the payout is tax free. Income earned in the form of interest is almost always taxable at some point. Estate tax The federal estate tax applies to high-value estates.

If an individual takes out a life insurance policy on someone other than himherself the policys benefits are considered a gift. Generally life insurance benefits paid out to individual beneficiaries arent subject to federal income tax. According to the IRS any money received from a life insurance policy is not required to be declared as gross income and does not need to be reported on your tax return.

Thats because you dont have to include life insurance payouts in your gross income or report them to the IRS. Life insurance is no exception. Life insurance payouts are made tax-free to beneficiaries.

A beneficiary would have to report and pay taxes on any interest earned or taxable gains made from the life insurance proceeds after receiving the money. The taxable amount is the net cash surrender value minus the premiums you paid into the policy. In other words the person or people who receive the payout do not automatically have.

For those estates that will owe taxes whether life insurance proceeds are included as part of the taxable estate depends on the ownership of the policy at the time of the insureds death. So for example lets say that you own a whole life insurance policy with 250000 in cash value. Because a life insurance death benefit isnt considered taxable income for most people income tax usually doesnt apply.

Group life insurance can be a nice addition to your benefits package especially if its free or nearly free. You paid 115000 in total premiums to date. The tax benefit is available in terms of income tax deduction and income tax exemption.

Various benefits are attached to the life insurance policy and tax benefit is one such key benefit. The money is typically distributed tax-free to the beneficiaries. Most of the time life insurance is not taxable.

Life insurance is a great way to create a financial legacy you can leave to your family after you pass away. Well talk more about when you do have to pay later. However any interest you receive is taxable and you should report it as interest received.

We want to put your mind at ease first by highlighting some specific instances where you dont have to worry about taxes on life insurance. This means when a beneficiary receives life insurance proceeds after a period of.

Income Tax Benefits In Life Insurance Understand How The Tax Exemptions Work

Income Tax Benefits In Life Insurance Understand How The Tax Exemptions Work

Tax Benefits Of Whole Life Insurance The Insurance Pro Blog

Tax Benefits Of Whole Life Insurance The Insurance Pro Blog

Is Life Insurance Taxable Forbes Advisor

Is Life Insurance Taxable Forbes Advisor

Are Life Insurance Payouts Taxable Life Insurance Taxability Explained

Are Life Insurance Payouts Taxable Life Insurance Taxability Explained

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable Visual Ly

Is Life Insurance Taxable Visual Ly

How To Calculate Life Insurance Payouts Page 1 Line 17qq Com

How To Calculate Life Insurance Payouts Page 1 Line 17qq Com

Is Life Insurance Ever Taxable

Is Life Insurance Ever Taxable

Buying Life Insurance One Tip To Save You Thousands By Perseveranceinsurance Issuu

Buying Life Insurance One Tip To Save You Thousands By Perseveranceinsurance Issuu

Is Life Insurance Taxable Policygenius

Is Life Insurance Taxable Policygenius

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg) Understanding Taxes On Life Insurance Premiums

Understanding Taxes On Life Insurance Premiums

Comments

Post a Comment