Why Is Congress Dealing With Insider Trading Now. Insider Trading in Congress Is Preventable.

Congress Cashes In On Insider Trading Representus

Congress Cashes In On Insider Trading Representus

CORRECTION October 21 2020.

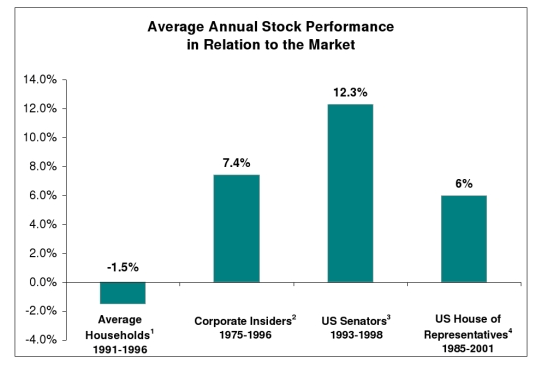

Insider trading congress. 300 Assets to Invest Wide Range of Lucrative Assets. At its core insider trading unfairly enriches privileged parties at the expense of. Congressional insider trading has long been a hot issue and lawmakers continue to look for a way to put an end to the practice.

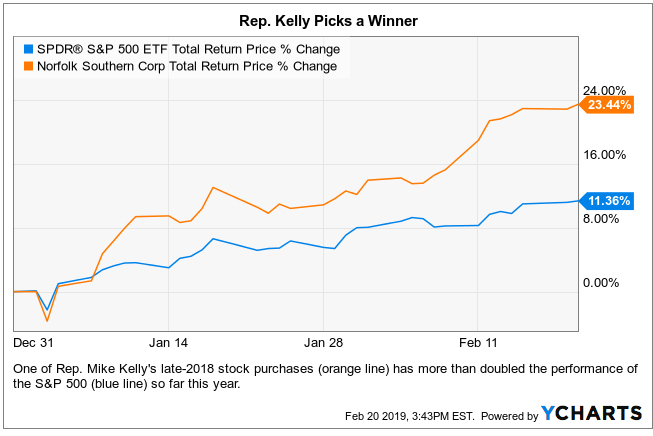

Recent allegations regarding stock trading by. Ad Buat prediksi dan lihat hasilnya dalam 1 menit. Four members were investigated.

Bonus sambutan untuk pemula. The federal STOCK Act could be put to its biggest test yet after it emerged that some US. But even if that approach of the insider trading law clearly did apply to Congress bringing a criminal case would be difficult for prosecutors because of the immunity provided by the Constitution.

Senators may have parlayed nonpublic information about the coronavirus outbreak into potentially. But there are more interesting questions to be asked about this seedy phenomenon. A previous version of this video mischaracterized the investment returns from one study.

222 1980 and Dirks v. The story provoked a furor among the public leading to the enactment of the STOCK Act which President Obama signed into law on April 4 2012. In 2012 the STOCK Act was passed following allegations of.

Then in 2014 the US. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

Coba strategi Anda dengan perdagangan kecil mulai dari 1. Congress makes decisions about economic policy foreign relations tax reform and other matters that directly affect the bottom lines of publicly traded companies. Pengaturan trading yang fleksibel.

Since 2012 the STOCK Act has not been brought down upon any member of Congress. Bonus sambutan untuk pemula. Senator Richard Burr from North Carolina was a fierce opponent of a bill that ultimately banned this practice.

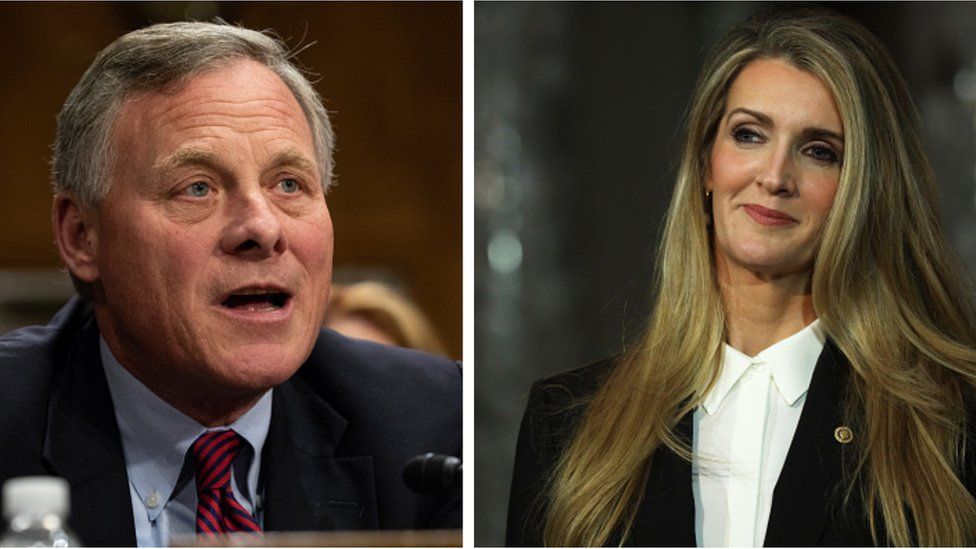

They should have been characterized a. The Department of Justice has now closed all of its investigations into insider trading against members of Congress. The Justice Department is investigating stock trades made by Sen.

Insider Trading and Securities Fraud Enforcement Act of 1988 After a number of hearings and considerable debate in the 100th Congress the President signed the Insider Trading and Securities Fraud Enforcement Act of 19889 This act expanded the scope of civil penalties to control persons who fail to take adequate steps to prevent insider trading10. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors. Ad Buat prediksi dan lihat hasilnya dalam 1 menit.

Chiarella insider trading case 1980 For decades the seminal insider trading cases have been Chiarella v. Prior to 2012 Congress members were not prohibited from insider trading. 300 Assets to Invest Wide Range of Lucrative Assets.

Richard Burr R-NC after a briefing on the coronavirus. In mid-November 2011 CBS 60 Minutes ran a story alleging that Members of Congress were using insider information to benefit on stock trades. How does Congress get away with insider trading.

Pengaturan trading yang fleksibel. Insider trading or the act of buying or selling investments based on nonpublic information is against the law.

The Investing Skills Of Members Of Congress Look Patchy The Economist

The Investing Skills Of Members Of Congress Look Patchy The Economist

How To Profit From Congressional Insider Trading

How To Profit From Congressional Insider Trading

How Congress Quietly Overhauled Its Insider Trading Law It S All Politics Npr

How Congress Quietly Overhauled Its Insider Trading Law It S All Politics Npr

Insider Trading And Congress How Lawmakers Get Rich From The Stock Market Youtube

Insider Trading And Congress How Lawmakers Get Rich From The Stock Market Youtube

Congressional Insider Trading A Case Study In Moral Hazard Sky Dancing

Congressional Insider Trading A Case Study In Moral Hazard Sky Dancing

Insider Trading By Congress It S Time To Fix The Law Thehill

Insider Trading By Congress It S Time To Fix The Law Thehill

Insider Trading Was Illegal For Martha Stewart But It S Business As Usual For Senator Ted Cruz The Chicago Board Of Tirade

Why Congressional Insider Trading Is Legal And Profitable Investment U

Coronavirus Us Senators Face Calls To Resign Over Insider Trading Bbc News

Coronavirus Us Senators Face Calls To Resign Over Insider Trading Bbc News

Senators Accused Of Insider Trading Dumping Stocks After Coronavirus Briefing

Senators Accused Of Insider Trading Dumping Stocks After Coronavirus Briefing

Congress Cashes In On Insider Trading Representus

Congress Cashes In On Insider Trading Representus

Two Senators Under Scrutiny Over Selling Stock Before The Coronavirus Market Crash But Do Insider Trading Laws Apply Marketwatch

Two Senators Under Scrutiny Over Selling Stock Before The Coronavirus Market Crash But Do Insider Trading Laws Apply Marketwatch

Insider Trading By Members Of Congress An Enforcement Nightmare Corruption Crime Compliance

Insider Trading By Members Of Congress An Enforcement Nightmare Corruption Crime Compliance

How To Profit From Congressional Insider Trading

How To Profit From Congressional Insider Trading

Comments

Post a Comment