These funds are based on an underlying index like NIFTY SENSEX etc. Fidelity NASDAQ Composite Index.

These Five Index Funds Beat Their Indices Why You Should Avoid Them

These Five Index Funds Beat Their Indices Why You Should Avoid Them

Browse a list of Vanguard funds including performance details for both index and active mutual funds.

Index funds list. Fidelity 500 Index Fund FXAIX FXAIX is a mutual fund. Lowest Cost SP 500 Index Fund. Free from Fund Managers biases this list gives you a truly automated equity portfolio of top companies.

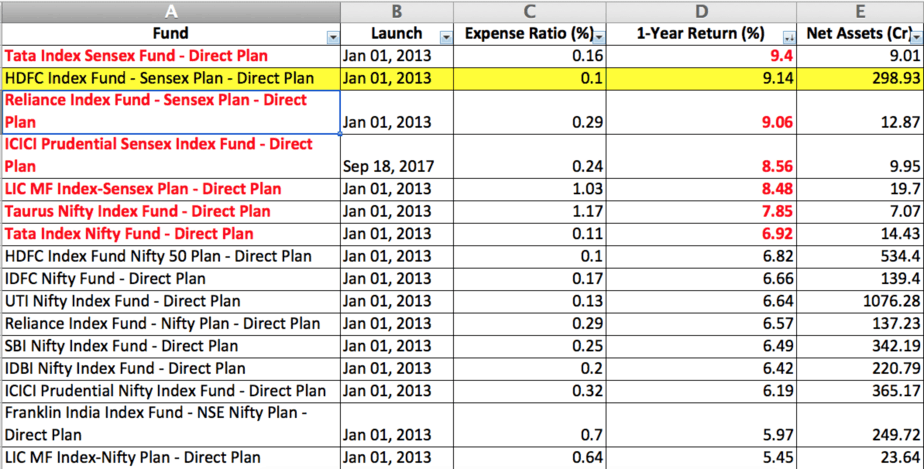

9 Best performing Index Funds to invest in FY 21 - 22 2021 - 2022 are Nippon India Index Fund - Sensex Plan LIC MF Index Fund Sensex ICICI Prudential Nifty Index Fund UTI Nifty Index Fund Franklin India Index Fund Nifty Plan SBI Nifty Index Fund. Index funds hold a selection of stocks that make up an index. While an actively managed fund may charge you anything between 1-2 as TER an index fund would typically charge you between.

Here are two of the cheapest mutual funds tracking small-cap stock indices. When you purchase shares of an index fund youre basically buying into that market as a whole. Large-Cap ETF has been on the market since 2009.

While a managed fund may individually choose stocks index funds invest in most of the funds in a specific index ie SP 500 Dow Jones Nasdaq. Index mutual funds track various indexes. For example an SP 500 index fund buys shares in all the companies listed on the index.

And simply mirror the returns of that index. Here we look at a few of the most highly rated low-cost SP 500 index funds. The Standard Poors 500 index is one of the best-known indexes because the 500 companies it tracks.

This fund invests only in large-cap stocks that have growth potential which makes it a bit riskier but also potentially more rewarding in the long run than SP 500 Index fundsThe expense ratio for VIGAX is a low 005 and the minimum initial investment is 3000. Index funds are additionally known to provide broad market exposure and low portfolio turnover to the investors. Index funds give investors an indirect way to gain exposure to the whole market.

Total market index funds are based on indexes like. The NASDAQ Index consists of mostly large-cap stocks. For example Vanguards Australian Shares Index Fund tracks the ASX300 index a.

These index funds will track small-cap indices like the Russell 2000 Index or the SP SmallCap 600 index. Benzinga has compiled a list of a few of the best index funds and they include the following. Index funds are passive investing vehicles that duplicate the performance of an underlying index.

Having shares in a Vanguard US stock index fund is like having shares in the entire US stock market. Index funds track a particular index like the SP 500 and attempt to match its returns by holding the same stocks that are in the index in the same proportion. Index Funds are the most advocated way to invest by legendary investors like Warren Buffett for retail investors.

Northern Small Cap Index NSIDX. Since index funds are passively managed the total expense ratio TER is very less as compared to the actively managed ones. Vanguard Growth Index.

The expense ratio is 015 or 15 for every 10000 invested and the minimum initial investment is 2500.

List Of Fund Managers Of Sensex Index Funds Download Table

List Of Fund Managers Of Sensex Index Funds Download Table

5 Best Index Mutual Funds To Invest In 2020 To Beat Corona Virus Situation

5 Best Index Mutual Funds To Invest In 2020 To Beat Corona Virus Situation

List Of Index Funds In India 2021 Basunivesh

List Of Index Funds In India 2021 Basunivesh

How To Use Vanguard Index Funds For Active Index Investing And Trading Simple Stock Trading

List Of Index Funds In India 2021 Basunivesh

List Of Index Funds In India 2021 Basunivesh

What Are The Best Performing Index Funds

What Are The Best Performing Index Funds

The 8 Best Vanguard Funds Worth Buying Right Now In February 2021 Finance Investing Personal Finance Finance

The 8 Best Vanguard Funds Worth Buying Right Now In February 2021 Finance Investing Personal Finance Finance

List Of Index Funds In India 2020 Basunivesh

List Of Index Funds In India 2020 Basunivesh

John A Haslem S Research Works University Of Maryland College Park Md Umd Umcp University Of Maryland College Park And Other Places

John A Haslem S Research Works University Of Maryland College Park Md Umd Umcp University Of Maryland College Park And Other Places

10 Most Popular Stocks Funds And Etfs Of 2019 Morningstar

10 Most Popular Stocks Funds And Etfs Of 2019 Morningstar

How To Invest In Index Funds A Beginner S Guide

How To Invest In Index Funds A Beginner S Guide

What Are The Best Index Funds To Buy Quora

Comments

Post a Comment