Terms and conditions apply. Remember this is just a tax estimator so you should file a proper tax return to get exact figures.

Income taxes due for the year.

How much would i get back in taxes. For example if you had 30000 in taxable income with one exemption for yourself one exemption for your wife and one exemption for a child that would be three exemptions worth 4050 each or 12150 for all three. Tax refunds peak for adults in the 35-to-44 age range and then. Tax refund amounts tend to rise with income.

Click here for a 2020 Federal Income Tax Estimator. A tax credit valued at 1000 for instance lowers your tax bill by 1000. Well the average tax refund is about 3046 per The Washington Post.

Certain credits may even be refundable which means you can claim them even if you dont have any tax liability. How much tax will you save and get back from the tax man. The way one exemption works is to reduce a persons taxable income by 4050.

In 2018 the standard deduction jumps to 12000 for singles 18000 for heads of household and 24000 for couples filing jointly. How much you owe the IRS. Up to 1400 of this amount is refundable depending on your income.

So how much are YOU going to get back in taxes in 2021. Its like if you went to Walmart bought 14 worth of items and gave the cashier a 20 bill - the 6 you get back is just your overpayment. See Accurate Calculations Guarantee for details.

This has doubled the previous amount and the Child Tax Credit was previously only refundable if you were also claiming the Additional Child Tax Credit. How much refund will I get. Our free tax calculator can provide a better picture of what youll be owed after you file.

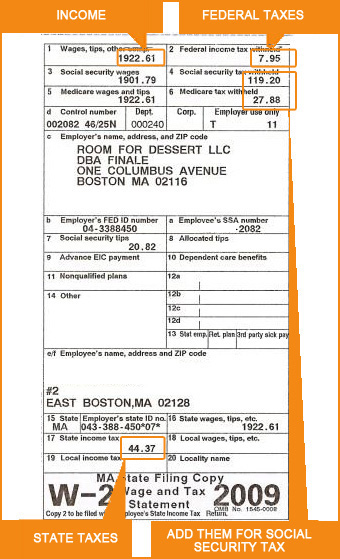

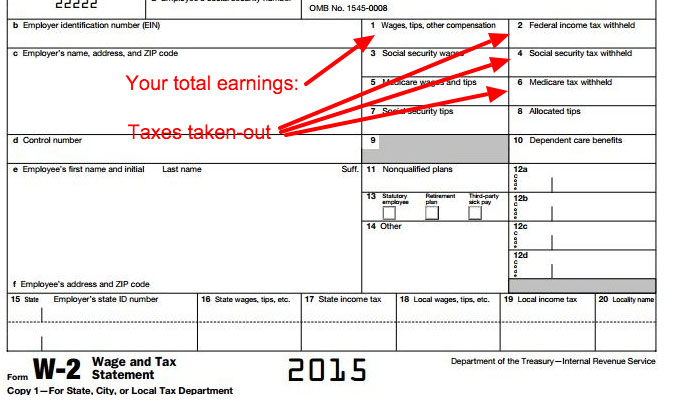

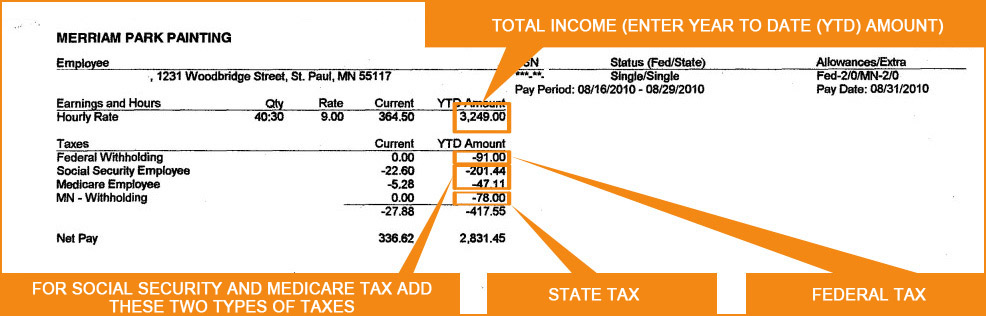

This should be for your current tax return that is due. This up to date tax calculator applies to the last financial year ending on 30 June. Did you withhold enough in taxes this past year.

If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty andor interest to the IRS that you would otherwise not have been required to pay HR Block will reimburse you up to a maximum of 10000. If you had too much withheld then you get your overpayment refunded. But the cost for itemizing is giving up the standard deduction.

The amount refunded from the Child Tax Credit can only be equal to 15 of your total earned income above the limit of 2500. Get a Bigger Tax Refund. The child tax credit is worth up to 2000 for the 2020 tax year for those who meet its requirements.

If the amount withheld from your paychecks for taxes exceeds the amount you owe then you will receive a refund. The amount of money you get back also depends on your income bracket and any deductions or tax credits you qualify for at tax time. There are several factors that can impact how much income tax you pay.

Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the IRS. Any income earned over 180000 attracts tax at 45 cents in the dollar including the Medicare levy of two percent so a 1 tax deduction will give you a tax saving of 45 percent. Tax refunds are calculated by subtracting the amount of federal income taxes withheld from your total.

Estimate how big your refund will be with our easy-to-use free income tax calculator. 2020 tax refund estimator. Claim Your Credits A tax credit reduces the amount of tax you owe to the IRS on a dollar-for-dollar basis.

So expect around three grand for your tax refund. To figure your tax savings multiply your tax rate by your mortgage interest deduction. However that 10000 deduction results in you getting more money back from your income taxes if you have 500000 in taxable income because you fall in a higher income tax bracket.

For example if you owe 6000 in taxes and claim a credit worth 1000 your bill drops to 5000. Having dependent children may also allow you to claim other significant tax credits including. Tax deductions on the other hand reduce how much of your income is subject to taxes.

The average tax refund in 2018 was 2881. Higher Tax Savings in 2017 For the 2017 tax year medical deduction savings are potentially larger for two reasons. At the end of the year you calculate how much total tax you owe on what you made.

Tax refunds vary depending on whats been withheld from your income vs.

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

Quick Tax Refund If You Worked In The Us Rt Tax

Quick Tax Refund If You Worked In The Us Rt Tax

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

11 Common Tax Lies You Should Avoid Creditloan Com

11 Common Tax Lies You Should Avoid Creditloan Com

Quick Tax Refund If You Worked In The Us Rt Tax

Quick Tax Refund If You Worked In The Us Rt Tax

How Do They Figure How Much You Get Back For Medical Deductions On Taxes

How Do They Figure How Much You Get Back For Medical Deductions On Taxes

Tax Calculator And Refund Estimator 2020 2021 Turbotax Official

Tax Calculator And Refund Estimator 2020 2021 Turbotax Official

How The Rich Would Benefit From The Liberals Middle Class Tax Cut Macleans Ca

How The Rich Would Benefit From The Liberals Middle Class Tax Cut Macleans Ca

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

How You Could Get An Extra 99 Per Fortnight In Your Pocket Daily Mail Online

How You Could Get An Extra 99 Per Fortnight In Your Pocket Daily Mail Online

Yourfreetaxmoney United Way California Capital Region

Yourfreetaxmoney United Way California Capital Region

New Tax Law Take Home Pay Calculator For 75 000 Salary

Comments

Post a Comment