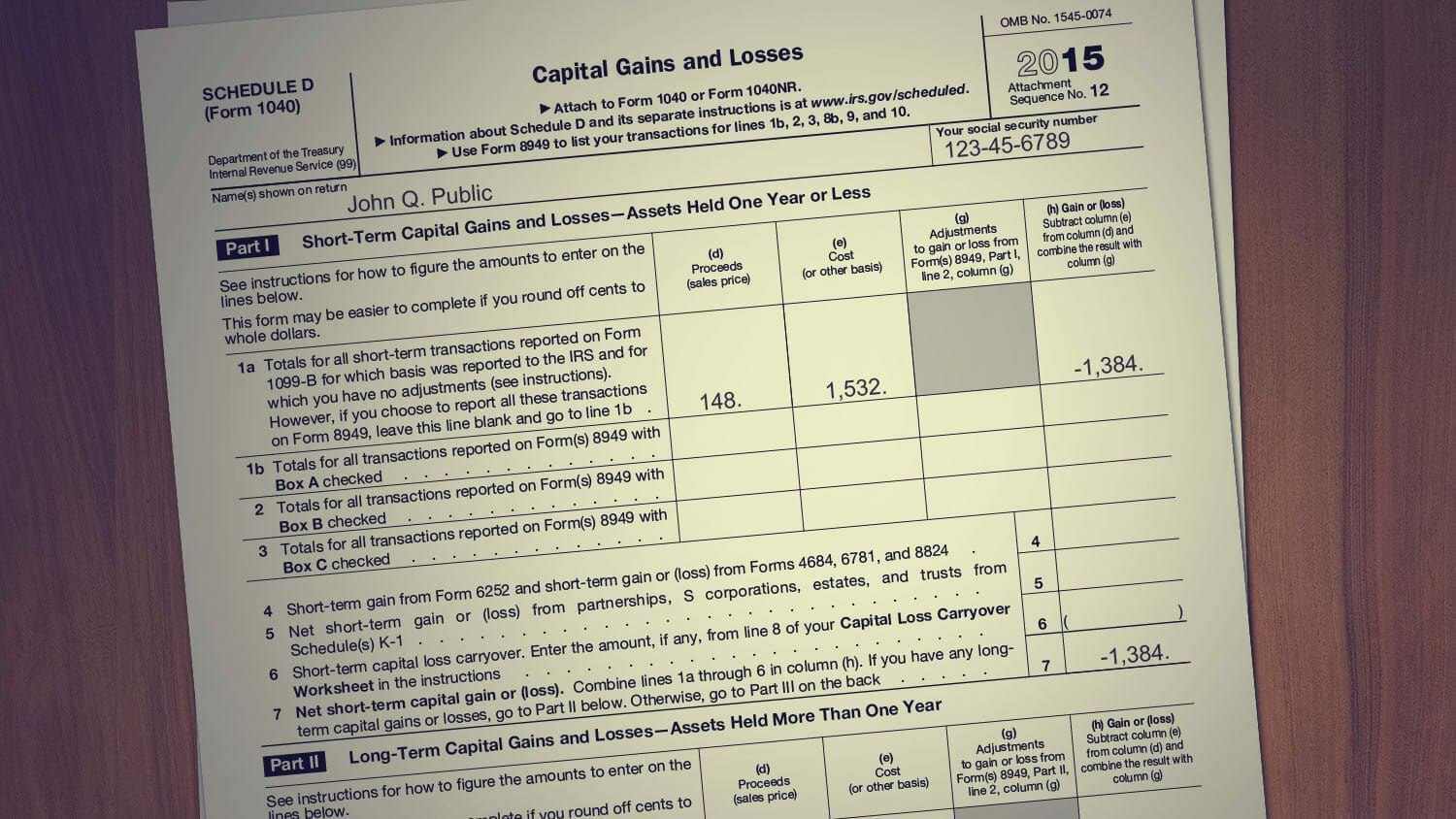

If You Buy or Sell Your Investments If you sell some of your investments at a gain you will have to pay taxes on the profits you made. It is also important to note that registered accounts like RRSPs have an exemption from US.

When the proceeds are paid out to you they always count as income and you are treated as if tax at the basic rate of 20 has already been deducted.

/Taxes-b5743df0be814fe9a34c2f2255f47fb2.jpg)

Do you have to pay taxes on investments. If youre going to start living off your investments and will no longer have income withheld from a payroll check you may need to start making quarterly estimated tax payments. Depending on your overall income tax bracket stock sales are taxed at a rate of either zero 15 20 or 238 percent Blain says. If so you can choose to include the income on your return.

For instance an investor who pays federal income tax at a marginal 35 rate and receives a qualified 500 dividend on a stock owned in a taxable account for several years owes up to 100 in tax. Use Form 8615 to figure the tax on your childs investment income. This is also true of money you make on your investments.

How to Possibly Pay 0 in Taxes on Your Taxable Investment Gains We dont need to go through every bracket here you can see which bracket youre in. Capital gains are taxed at different rates depending on whether they are considered a short-term or long-term holding. The Basics of Net Investment Income Tax The net investment income tax thresholds are based on your filing status and income.

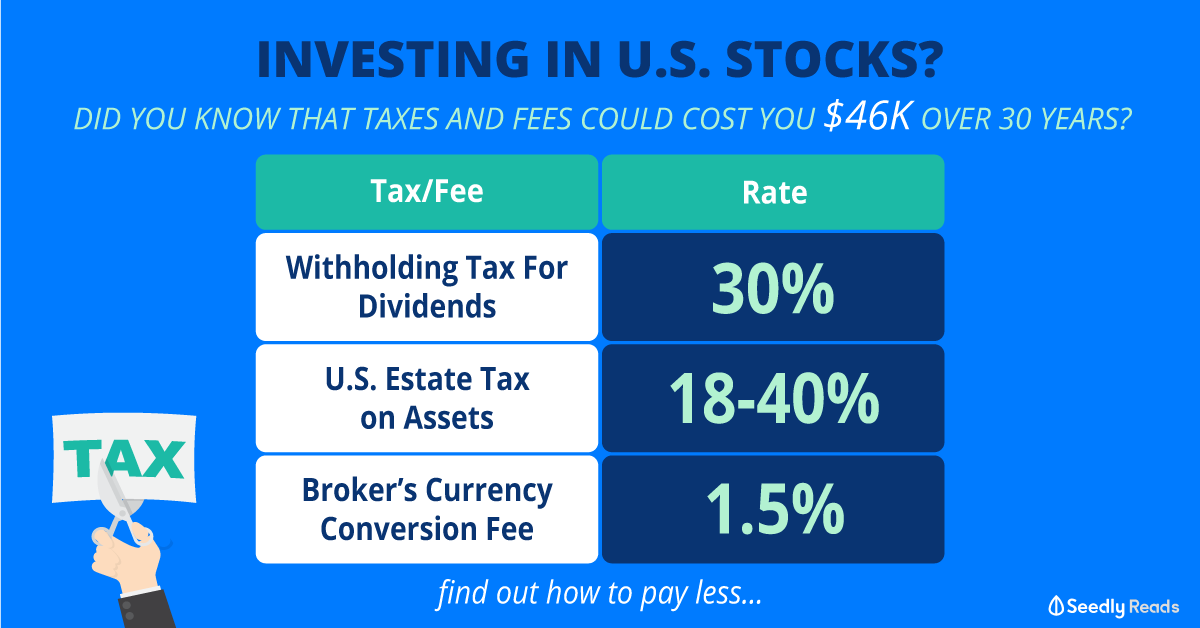

You typically only have to pay taxes on the sale of investments when you receive a gain. One way to invest in investment funds is through a life insurance policy. Stocks bonds or ETFs that own US.

This tax cant be reclaimed. You may have to pay extra types of tax if you make money from your investments. Taxes on Investments The investments you make with Stash are taxed the same way as any other investment.

Here is how tax on investment income is applied based on your tax band. The tax rates can vary depending on the type of investment for nonresident aliens. Because if after withholding and credits you would still owe at least 1000 in taxes then the rules say you must make estimated payments throughout the year.

Are not subject to capital gains taxes. You are likely subject to this tax if you have investment income and your modified adjusted gross income exceeds certain thresholds. Most investment property can be depreciated over a period of 275 years or 3636 per year.

The information on this page is based on UK regulations for the 20202021 tax year. This is called a capital gain. Since it seems that you had no.

To figure this out you have to subtract the cost basis of your investment which is normally what you paid from the sale price to see if you had a gain. While most investors are often the most concerned about capital gains depreciation recapture is actually the first tax bill you have to pay when you sell an investment property. How much can a child earn before paying taxes your childs investment income might be more than 2200 and less than 11000.

The insurance company owns the funds and has to pay tax on income and gains they make. Some taxes are due only when you sell investments at a profit while other taxes are due when your investments pay you a distribution. For example investments in the US.

This means you will need to pay taxes on money you make through capital gains dividends and income interest. In many cases you wont owe taxes on earnings until you take. For the federal capital gains tax rate it depends on an investors.

Withholding tax if you own US. One of the benefits of retirement and college accountslike IRAs and 529 accounts is that the tax treatment of the money you earn is a little different. Youll use Form 8814 and your child wont need to file a return.

Do You Pay Taxes On Investments What You Need To Know Turbotax Tax Tips Videos

Do You Pay Taxes On Investments What You Need To Know Turbotax Tax Tips Videos

How Much Tax Do You Pay On Your Equity Investment

How Much Tax Do You Pay On Your Equity Investment

/Taxes-b5743df0be814fe9a34c2f2255f47fb2.jpg) Will I Have To Pay Taxes On Any Stocks I Own

Will I Have To Pay Taxes On Any Stocks I Own

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Day Trading Don T Forget About Taxes Wealthfront Blog

Day Trading Don T Forget About Taxes Wealthfront Blog

Three Different Routes To Save Tax On Long Term Capital Gains

Three Different Routes To Save Tax On Long Term Capital Gains

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png) Estimating Taxes In Retirement

Estimating Taxes In Retirement

Definitive U S Stock Investing Taxes And Fees Guide For Singaporean Investors

Definitive U S Stock Investing Taxes And Fees Guide For Singaporean Investors

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

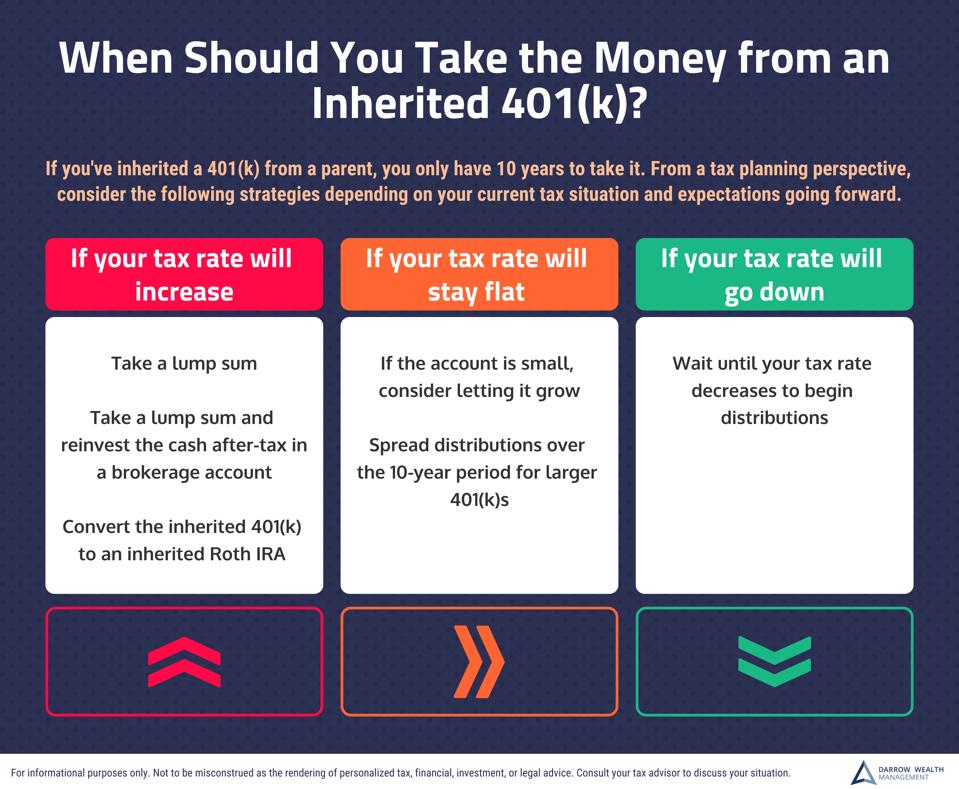

If You Inherited A 401 K From A Parent Here S When You Need To Take The Money And When You Should

If You Inherited A 401 K From A Parent Here S When You Need To Take The Money And When You Should

How Much Tax Do You Need To Pay For Your Equity Investments

How Much Tax Do You Need To Pay For Your Equity Investments

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png) Three Taxes Can Affect Your Inheritance

Three Taxes Can Affect Your Inheritance

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Comments

Post a Comment