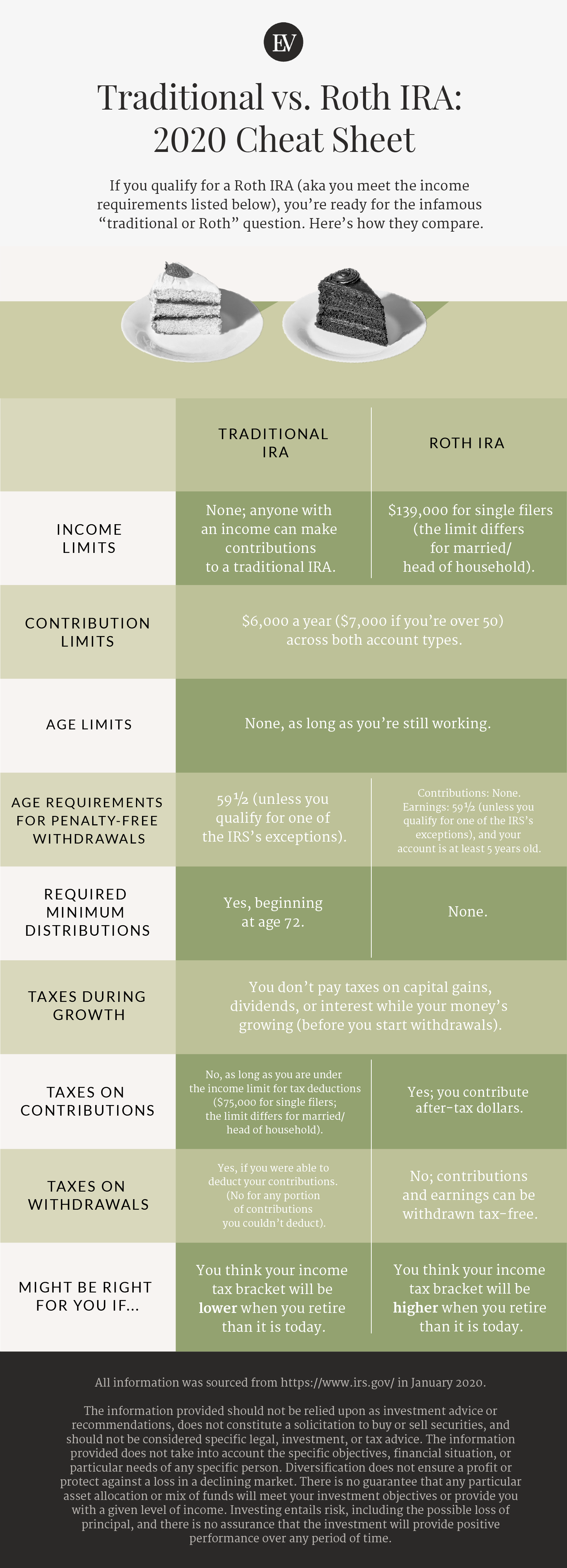

You wont have to pay the early-distribution penalty 10 additional tax on your Roth IRA withdrawal if all of these apply. The 10 penalty can be waived however if you meet one of eight exceptions to the early withdrawal penalty tax.

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

You can withdraw contributions you made to your Roth IRA anytime tax- and penalty-free.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Do you pay taxes on roth ira withdrawals. You can withdraw your Roth IRA contributions at any time for any reason with no tax or penalties. IRA withdrawals must be recorded on your income tax returns even if you do not owe any tax. If you follow IRS rules earnings grow tax-free and you dont.

The income tax was paid when the money was deposited. If you take a qualified withdrawal from a Roth IRA you wont pay income tax on the money. Your Roth IRA withdrawals might be taxable if.

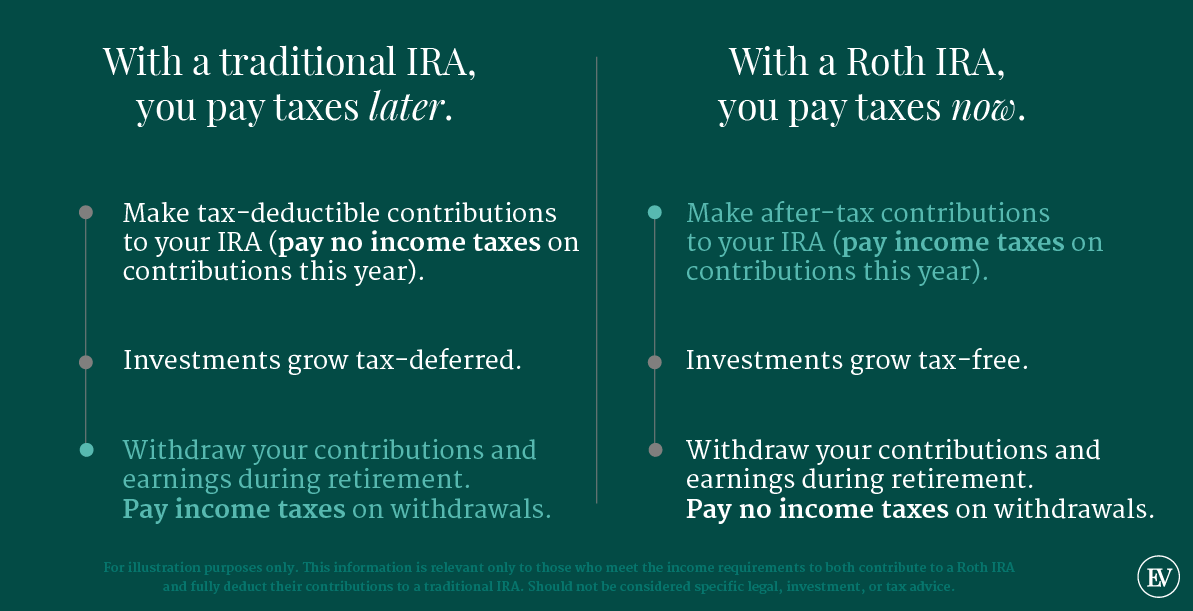

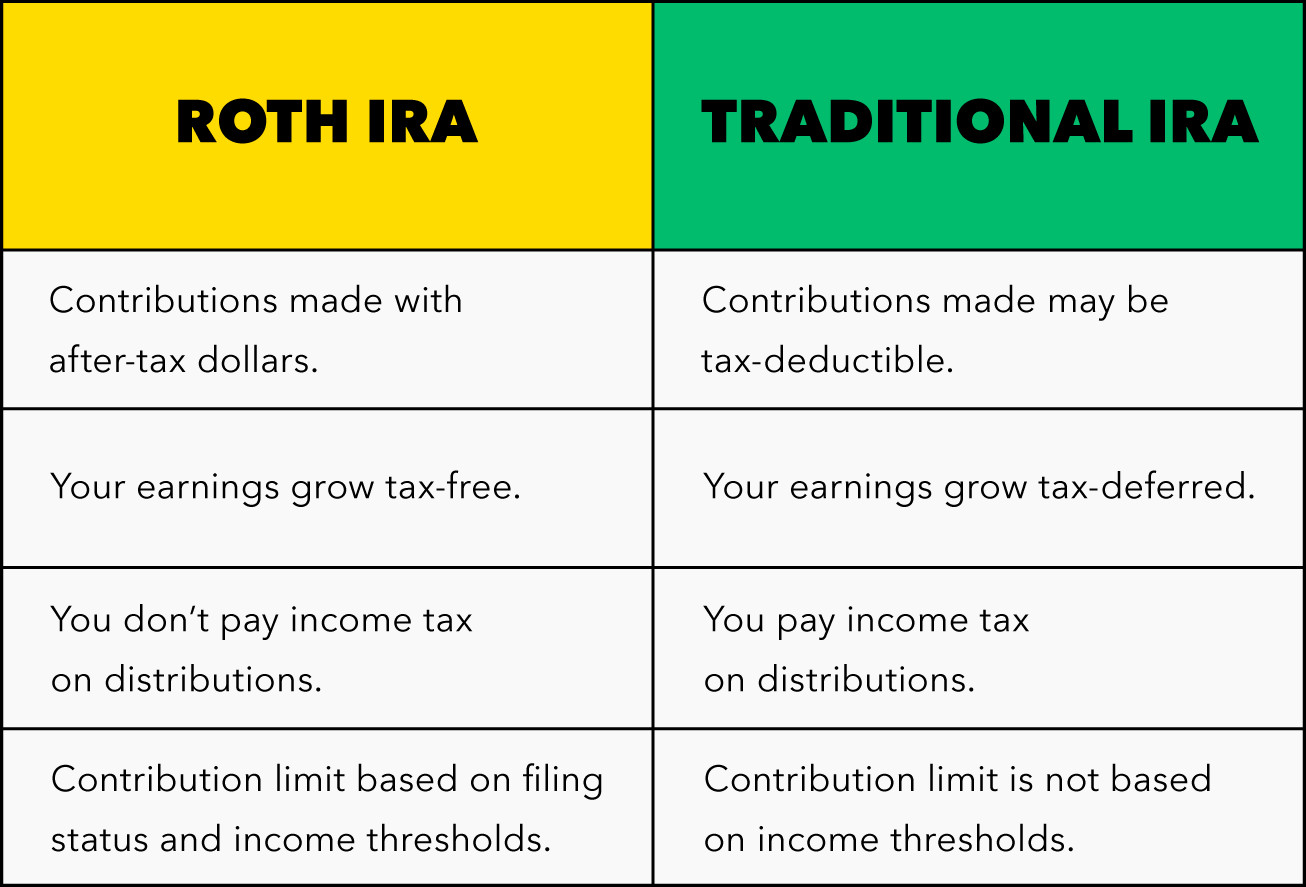

You can get your contributions back without paying any income taxes if you dont meet these criteria but earnings on the account are taxed. This is often the deciding factor when choosing between the two. Paying taxes from the IRA withdrawal allows you to do conversions while minimizing impact to your cash flow.

With traditional IRAs you have to begin taking required minimum distributions RMDs at age 72. Withdrawals from a Roth IRA youve had less than five years. Roth IRA withdrawals dont raise your combined income and they wont increase your chance of paying taxes on your Social Security benefits.

The Internal Revenue Service IRS wont tax you twice on the money you contribute to a Roth IRA although you do have to maintain the account for at least five years and as with traditional IRAs you must be at least age 59½ before you take distributions to avoid a penalty. If cash flow is not a problem then paying your taxes with outside money allows you to maximize the amount of money that ends up in your Roth account. Most of the time yes.

Youve not met the 5-year rule for opening the Roth and you are under age 59 ½. Only Roth IRAs offer tax-free withdrawals. The only portion of an inherited IRA that.

When you take a qualified distribution from a Roth IRA meaning you are at least 59 12 years old and the account has been open for at least five years you may withdraw as much as you want without paying any income taxes. You can withdraw your contributions tax-free and you wont have to pay a penalty but the growth on your Roth IRA will be taxed at your regular income tax rate. You havent met the five-year rule for opening the Roth and youre under age 59½.

However you may have to pay taxes and penalties on earnings in your Roth IRA. Thats because you make contributions with after-tax dollars so youve already paid income taxes. Withdrawals on earnings from a Roth IRA dont count as income but only if you make what the IRS deems as qualified distributions.

You will pay income taxes and a 10 penalty tax on earnings that are withdrawn. It would be unusual for any taxes to be due on an RMD from an inherited Roth IRA. Your Roth IRA withdrawals may be taxable if.

One of the attractive qualities of a Roth IRA is the ability to withdraw your contributions at any time without paying taxes. But you must be older than 59 12 to take a qualified withdrawal and your Roth IRA must be at least five years old. You pay taxes on the money you contribute to a Roth IRA at the time you make those contributions so you dont pay any on withdrawal.

There is no right way or wrong way to pay your taxes when doing Roth conversions. With Roth IRAs you pay taxes upfront and qualified withdrawals are tax-free for both contributions and earnings. You can still take early withdrawals from a traditional IRA but youll be on the hook for income taxes and in most circumstances youll pay the IRS a 10 early withdrawal penalty.

You can therefore take distributions from your Roth IRA tax-free. The 10 penalty may be waived if you meet one of the eight exceptions to the early withdrawal penalty tax. As you do so you pay taxes on the.

The amounts withdrawn arent more than your your spouses your childs andor your grandchilds qualified higher-education expenses paid during 2020. Youll pay income taxes and a 10 penalty tax on earnings you withdraw as of 2021. Roth IRAs are particularly valuable as estate-planning tools.

If you withdraw money before age 59½ you will.

How To Access Retirement Funds Early

How To Access Retirement Funds Early

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Ira Rules What You Need To Know In 2019 Mintlife Blog

Roth Ira Rules What You Need To Know In 2019 Mintlife Blog

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png) Exceptions To The Ira Early Withdrawal Penalty Tax

Exceptions To The Ira Early Withdrawal Penalty Tax

Roth Ira Early Withdrawals When To Withdraw Potential Penalties

Roth Ira Early Withdrawals When To Withdraw Potential Penalties

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Roth Ira Withdrawal Rules Oblivious Investor

Roth Ira Withdrawal Rules Oblivious Investor

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

What Are The Taxes On My Ira Withdrawal Legacy Planning Law Group

What Are The Taxes On My Ira Withdrawal Legacy Planning Law Group

/Takingmoneyoutofanira-98057a4d86a843f99b9141cd5c111009.png)

Comments

Post a Comment