It pays the cost to build and put back together your home as it was after the damages or losses either caused by a disaster regardless of the limits of your policy. Its typically between 10 percent and 25 percent.

What Is Extended Replacement Cost Hippo

What Is Extended Replacement Cost Hippo

Guaranteed replacement cost coverage pays to rebuild your house no matter that the cost.

Extended replacement cost. It will give you a bump in coverage that will offset any of those expenses you just cant plan for. Guaranteed replacement cost will pay to repair or rebuild. An Extended Replacement Cost ERC endorsement 1 can be added to a policy to increase the stated limits for your dwellingbuilding and potentially other structures.

This is often referred to as extended replacement cost. Our same 200000 home would qualify for an additional 50000 in replacement cost coverage if you chose the 25 percent extended coverage. Extended replacement cost is an expansion of your current dwelling coverage limit it helps cover extra rebuilding costs that are outside of your control.

Extended replacement cost is an upgrade or endorsement of your standard replacement cost claim settlement terms. Surface Pro X. Extended replacement cost generally pays to have your home repaired or rebuilt to its condition before the loss even if the cost exceeds the policy limit up to a capped amount.

While 25 percent may seem like a lot there are often circumstances that cause costs to soar well beyond that. Surface Laptop 3 - 135 Liquid damage repair Screen or physical damage repair Battery replacement service General repair excludes liquid screen physical damage 53760 43080 36600 33360. There are other levels of extended replacement cost as well.

An Extended Replacement Cost policy will pay up to a specified percentage over an insureds policy limit in order to fully replace a damaged home. While youll want to increase the coverage on your house any time you make upgrades or renovate to reflect its new value sometimes the construction cost of rebuilding after a total loss can be more than youd expect. 3 The ERC endorsement is most often found in policies of property owners in areas prone to widespread natural disasters.

How does extended replacement cost work. So if your dwelling coverage is set at 400000. With extended replacement cost your insurer pays for your home to be rebuilt or repaired to its condition before the damage even if the loss amount is above your dwelling coverage policy limits.

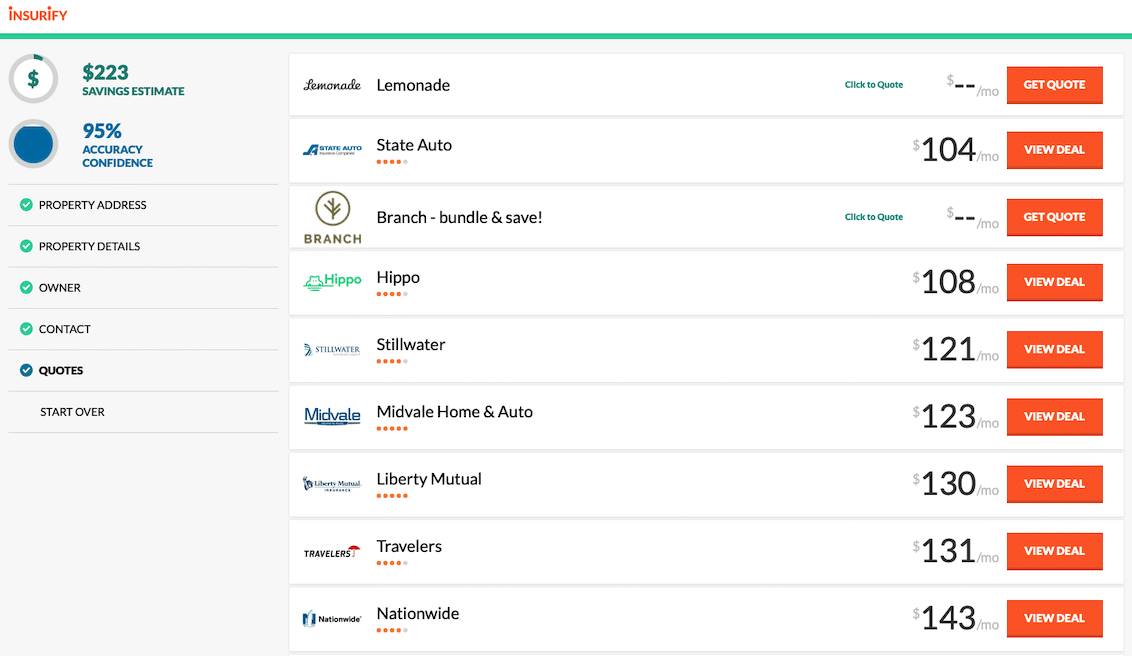

In the event of a total loss the insurance company would actually reimburse you up to 625000 to rebuild. Most homeowners will pay 5-20 per month but get the peace of mind knowing you have some cushion if the worst does happen. This percentage is often shown as 120 to 125 percent of the stated limit of coverage.

So if it cost 250000 to rebuild your home exactly the way it was youd be covered. Extended replacement cost coverage will pay a specific percentage over dwelling limit such as 20 over. If you had 300000 in Coverage A then.

So for a home insured at 300000 extended replacement cost would give you an extra 75000 to work with. Extended replacement cost refers to an insurance policy that usually provides a benefit over and above the limits specified by the policy for replacing a damaged house. Definition - What does Extended Replacement Cost mean.

This is a type of dwelling insurance that has the maximum level of coverage. Extended replacement coverage will cover repairs up to the policy amount but will depending on the replacement percentage you select cover an additional 25 200 of the policy amount for a covered claim. Extended replacement cost will reimburse you for the higher cost of rebuilding after a disaster.

How replacement cost is determined by insurance companies. The capped amount is an additional percentage such as 25 or 50 over the amount for which the home was insured. General repair excludes liquid screen physical damage 59160 49560 43080 37680.

In most cases adding the extended replacement cost to your policy isnt too expensive. 2 In homeowners policies this endorsement most commonly increases the stated limits 25-50. With extended replacement cost you would be reimbursed to the cost to repair or replace your home for a certain percentage over your policy limit.

This coverage could pay a benefit ranging from approximately 120 to 125 percent. This additional coverage can pick up some of the extra cost if your repairs exceed your policy coverage amount. Yet again if costs go beyond that extra 75000 you are on the hook to make up the difference or rebuild a smaller home.

You have extended replacement cost of 25. For example an extended replacement cost policy might provide 25 extra over your dwelling coverage amount. One form of coverage dwelling is the Extended Replacement Cost.

Premier Group Insurance Insurance 101 Insurance 101 Table Of Contents Auto Liability Coverage Umbi Umpd Medical Coverage Full Coverage Full Coverage Ppt Download

Premier Group Insurance Insurance 101 Insurance 101 Table Of Contents Auto Liability Coverage Umbi Umpd Medical Coverage Full Coverage Full Coverage Ppt Download

Extended Replacement Cost Coverage A Safeguard Against Demand Surge

Extended Replacement Cost Coverage A Safeguard Against Demand Surge

Ppt Insight On Property Valuation Part 2 Powerpoint Presentation Free Download Id 5585659

Ppt Insight On Property Valuation Part 2 Powerpoint Presentation Free Download Id 5585659

Why You Want Home Insurance With Extended Or Guaranteed Replacement Cost Forbes Advisor

Why You Want Home Insurance With Extended Or Guaranteed Replacement Cost Forbes Advisor

Extended Replacement Cost What It Is And How It Works

Extended Replacement Cost What It Is And How It Works

Extended Replacement Cost In Homeowners Insurance

Extended Replacement Cost In Homeowners Insurance

Consumer Alert Could Your Extended Replacement Cost Disappear Into Thin Air Insiders Guide Insurance

Public Adjuster Question Is There Extended Replacement Cost Coverage If I Buy Instead Of Rebuild Youtube

Public Adjuster Question Is There Extended Replacement Cost Coverage If I Buy Instead Of Rebuild Youtube

Home Replacement Cost Part Ii Nwpc

Home Replacement Cost Part Ii Nwpc

Consumer Alert Could Your Extended Replacement Cost Disappear Into Thin Air Insiders Guide Insurance

Extended Replacement Cost What Is It And Do I Really Need It Cover

Extended Replacement Cost What Is It And Do I Really Need It Cover

Replacement Cost Definition Examples What Is Replacement Cost

Replacement Cost Definition Examples What Is Replacement Cost

What Does Extended Replacement Cost Mean On A Homeowners Policy

What Does Extended Replacement Cost Mean On A Homeowners Policy

What Is Extended Replacement Cost Extended Replacement Cost Insurance Is An Endorsement Of Your Standard Repla Group Insurance Insurance Independent Insurance

What Is Extended Replacement Cost Extended Replacement Cost Insurance Is An Endorsement Of Your Standard Repla Group Insurance Insurance Independent Insurance

Comments

Post a Comment